### **Introduction & Investment Thesis Summary**

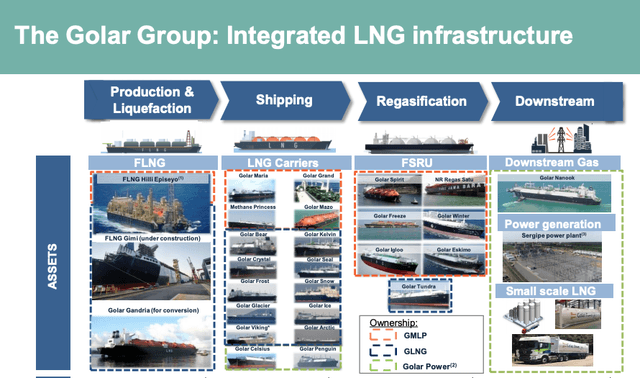

In a world increasingly shifting towards cleaner energy sources, LNG has become a crucial transition fuel. Golar LNG (NASDAQ: GLNG) is at the forefront of this transition, leveraging its expertise in floating LNG (FLNG) solutions to unlock stranded gas reserves across the globe. The company has undergone a strategic transformation, focusing exclusively on its FLNG business, which offers stable, long-term revenue streams through contracted liquefaction services. With a strong balance sheet, first-mover advantages, and a growing market for LNG, Golar LNG represents a compelling investment opportunity.

In simple terms, Golar is a specialist in **floating gas processing plants** that help countries and companies tap into offshore gas reserves, making it cheaper and more efficient to export LNG. Its innovative FLNG technology positions it uniquely in the market, providing high returns on investment. With its expansion into Argentina’s Vaca Muerta shale gas project and other global opportunities, the company is poised for significant growth.

**Summary**

Golar LNG Limited (NASDAQ: GLNG) is a leading player in the liquefied natural gas (LNG) infrastructure industry, specializing in floating LNG (FLNG) solutions. The company has streamlined its business, divesting non-core assets to focus on its core strength: FLNG. With a strong financial position and long-term contracts secured, Golar LNG is well-positioned for significant growth.

### Key Products/Services/Projects:

![[Pasted image 20250204004427.png]]

- **FLNG Hilli:** Operational since 2018, contracted to Perenco in Cameroon, with expansion planned in Argentina. (MKI)

- **FLNG Gimi:** Nearing completion, contracted to BP for 20 years at the Greater Tortue Ahmeyim project. (MKI)

- **MKII FLNG (2027 delivery):** Advanced next-generation FLNG solution with significant revenue potential.

- **MKII FLNG (2028 option):** A second MKII unit secured for potential deployment in high-demand regions.

### **Major Updates/Milestones:**

- **Long-Term Contracts:** 20-year contract for FLNG Hilli in Argentina, securing stable cash flows.

- **FLNG Gimi Commissioning:** Set to be operational by mid-2025, marking a major revenue milestone.

- **MKII FLNG Securing Contracts:** Expected within 2025, ensuring a strong backlog.

### **Market Outlook:**

- **LNG Demand Growth:** LNG is a key transition fuel, with increasing demand from Europe, Asia, and South America.

- **FLNG Competitive Advantage:** Cost-efficient offshore liquefaction solution vs. traditional onshore terminals.

- **Limited Competition:** Only a handful of companies operate in the FLNG space, with Golar LNG leading in execution and cost efficiency.

---

#### **Strategic Rationale**

**Focused Strategy:**

- Concentration on FLNG as a high-margin, long-term revenue-generating business.

- Targeting regions with stranded gas reserves that require cost-effective monetization.

**Innovation & Technology:**

- Proven track record with FLNG Hilli and Gimi.

- MKII FLNG design enhances efficiency and capacity at a competitive cost.

**Regulatory/Industry Alignment:**

- Compliance with global LNG safety and environmental standards.

- Positioned well within global energy transition strategies favoring LNG.

**Market Potential:**

- Growing natural gas demand and limited onshore liquefaction capacity create a favorable market.

- Strategic partnerships with major energy firms (BP, Perenco, Pan American Energy).

---

### **Value and Performance Indicators**

**Financials:**

- Adjusted EBITDA: $296M LTM (Q3 2024).

- Cash on Balance Sheet: $807M.

- Debt: $658M net interest-bearing debt.

**Operational Progress:**

- FLNG Hilli exceeding performance expectations.

- FLNG Gimi in final commissioning stage.

- MKII FLNG under construction with delivery in 2027.

**Market Opportunity:**

- Estimated $6B in contracted backlog.

- First available FLNG capacity in 2027, providing a first-mover advantage.

**Analyst/Market Sentiment:**

- Bullish outlook due to strong backlog and demand for FLNG.

- Potential for stock price increase as new contracts are secured.

---

### **Risks**

**Operational Risks:**

- Potential project delays or cost overruns on MKII FLNG.

- Technical risks in FLNG conversion and deployment.

**Market Risks:**

- LNG price volatility impacting long-term contract negotiations.

- Competition from onshore LNG terminals in cost-sensitive projects.

**Financial Risks:**

- Large capital expenditures for MKII and potential future FLNG projects.

- Dependence on securing long-term contracts for future FLNG units.

**Regulatory/Compliance Risks:**

- Changes in environmental policies affecting LNG investment attractiveness.

- Potential geopolitical risks impacting global LNG trade routes.

---

### **Geopolitical Dimensions & Enhanced Natural Gas Industry Dynamics**

**Argentina’s LNG Aspirations:**

- Argentina, through YPF, Pan American Energy, and Golar LNG, is positioning itself as a formidable LNG exporter.

- The Vaca Muerta shale formation, one of the largest in the world, is central to Argentina’s LNG ambitions.

- Collaboration with Brazil and Chile for gas exports further solidifies Argentina’s position.

- Economic instability, inflation, and lack of infrastructure pose challenges.

### **Competitive Global LNG Market:**

- The U.S. and Qatar dominate the LNG export market, with Argentina emerging as a challenger.

- High LNG demand in Europe and Asia due to energy security concerns post-COVID-19 and geopolitical tensions.

- Increasing LNG spot market liquidity, with shorter-term contracts becoming more prevalent.

### **Infrastructure & Financing Challenges:**

- Argentina requires significant investments in liquefaction plants, storage, and transportation infrastructure.

- High inflation and currency instability make foreign investment riskier but necessary.

- Golar LNG’s expertise in FLNG technology offers a cost-efficient solution to Argentina’s infrastructure gap.

### **Strategic Implications for Golar LNG:**

- Argentina’s success in LNG exports would provide long-term cash flow stability for Golar.

- Collaboration with YPF and Pan American Energy ensures Golar is well-positioned in South America.

- Diversification away from traditional markets in Africa and the Middle East mitigates geopolitical risks.

**Geopolitical Uncertainty & LNG Markets:**

- Ongoing geopolitical risks, including conflicts in Ukraine and the Middle East, are increasing global LNG demand.

- U.S.-China trade tensions and European energy security concerns create further opportunities for LNG exporters.

- Argentina’s potential rise as an LNG exporter could disrupt traditional market dynamics, especially in Asia and Europe.

- The growing influence of LNG in geopolitics could see increased government involvement in LNG contracts and partnerships.

---

**Potential Scenarios: Base / Bull / Bear**

**Base Case:**

- MKII FLNG secures a contract in 2025.

- FLNG Hilli and Gimi operate at full capacity.

- Stock price reaches $60+.

**Bull Case:**

- Additional MKII FLNG contract secured for 2028.

- Higher LNG prices boost revenue from commodity-linked contracts.

- Stock price exceeds $80.

**Bear Case:**

- Delays in contract negotiations or FLNG construction.

- LNG demand softens due to economic downturn.

- Stock price stagnates around $40.

**For a $1,000 Investment:**

- **Base Case:** $1,500-$1,800.

- **Bull Case:** $2,500+.

- **Bear Case:** $800-$1,000.

---

**Conclusion:** Golar LNG is a catalyst-driven investment. With a strong FLNG focus, geopolitical positioning in Argentina, and a favorable LNG market, the company is poised for substantial growth.

## References

[](https://static.seekingalpha.com/uploads/2020/12/7/32904585-1607393152124542_origin.png)

![[Pasted image 20250202132722.png]]

![[Pasted image 20250202132743.png]]

1. https://philosophycap.com/research/GLNG.pdf

2. https://www.mckinsey.com/industries/oil-and-gas/our-insights/the-future-of-liquefied-natural-gas-opportunities-for-growth#/

3. https://www.mckinsey.com/~/media/mckinsey/industries/oil%20and%20gas/our%20insights/the%20future%20of%20liquefied%20natural%20gas%20opportunities%20for%20growth/the-future-of-liquefied-natural-gas-opportunities-for-growth-vf.pdf?shouldIndex=false

4. https://www.golarlng.com/~/media/Files/G/Golar-Lng/documents/natural-gas-industry-seasonality.pdf

5. https://www.golarlng.com/~/media/Files/G/Golar-Lng/documents/presentation/golar-lng-limited-2024-q3-results-presentation.pdf

6. [[Natural Gas Value Chain]]