1) [$IREN](https://x.com/search?q=%24IREN&src=cashtag_click) - Intro

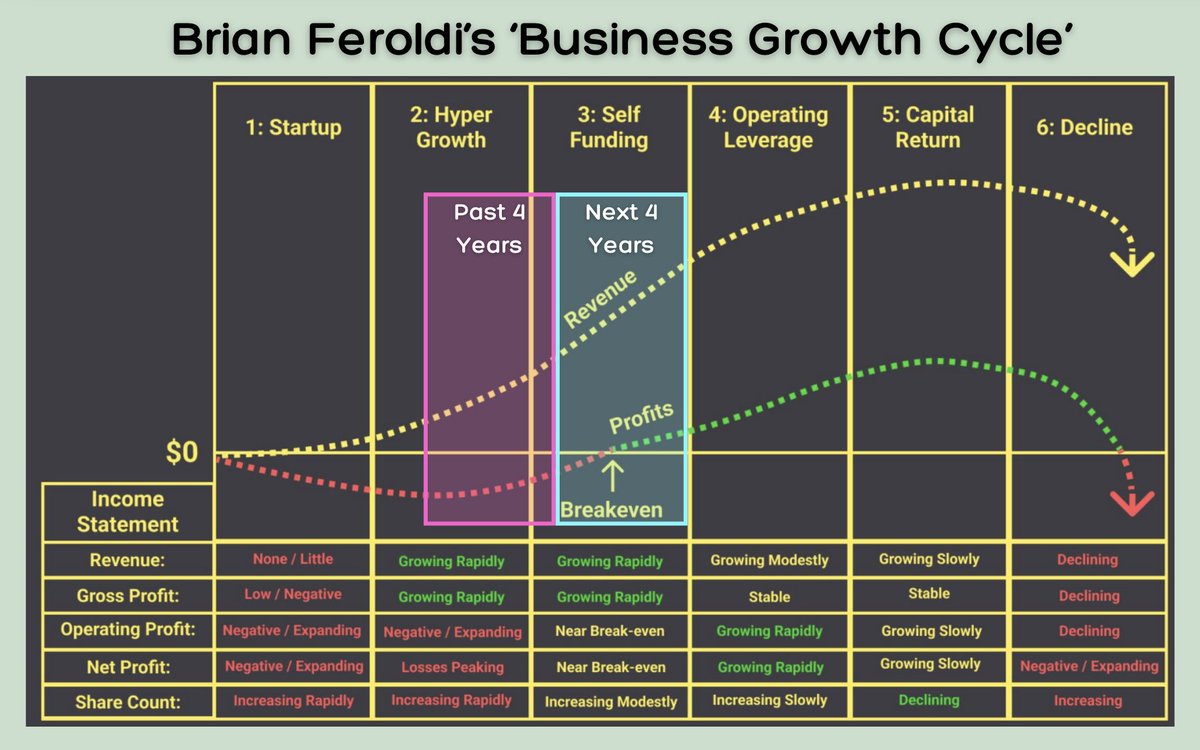

I believe that [$IREN](https://x.com/search?q=%24IREN&src=cashtag_click) is THE stock to hold over the coming years, as it is positioned at the center of the two strongest 'narratives' of this business cycle & bull market – AI and Bitcoin. This small cap, with a market cap of just ~$2.3 billion, builds and operates data centers to support high-performance computing applications (HPC), such as [$BTC](https://x.com/search?q=%24BTC&src=cashtag_click) mining and AI, leveraging cheap renewable energy sources.

[@IREN](https://x.com/IREN)

was founded in the fall of 2018 by the Australian brothers Will & Dan Roberts (

[@danroberts0101](https://x.com/danroberts0101)

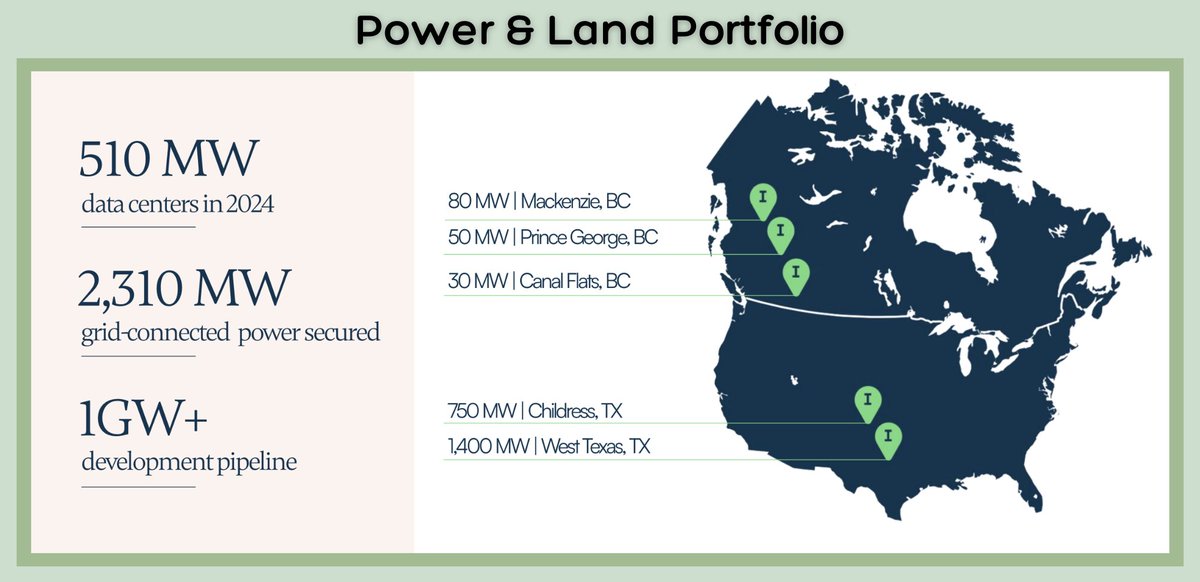

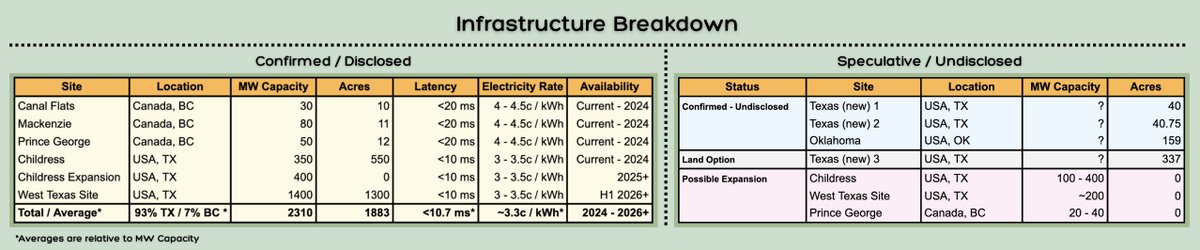

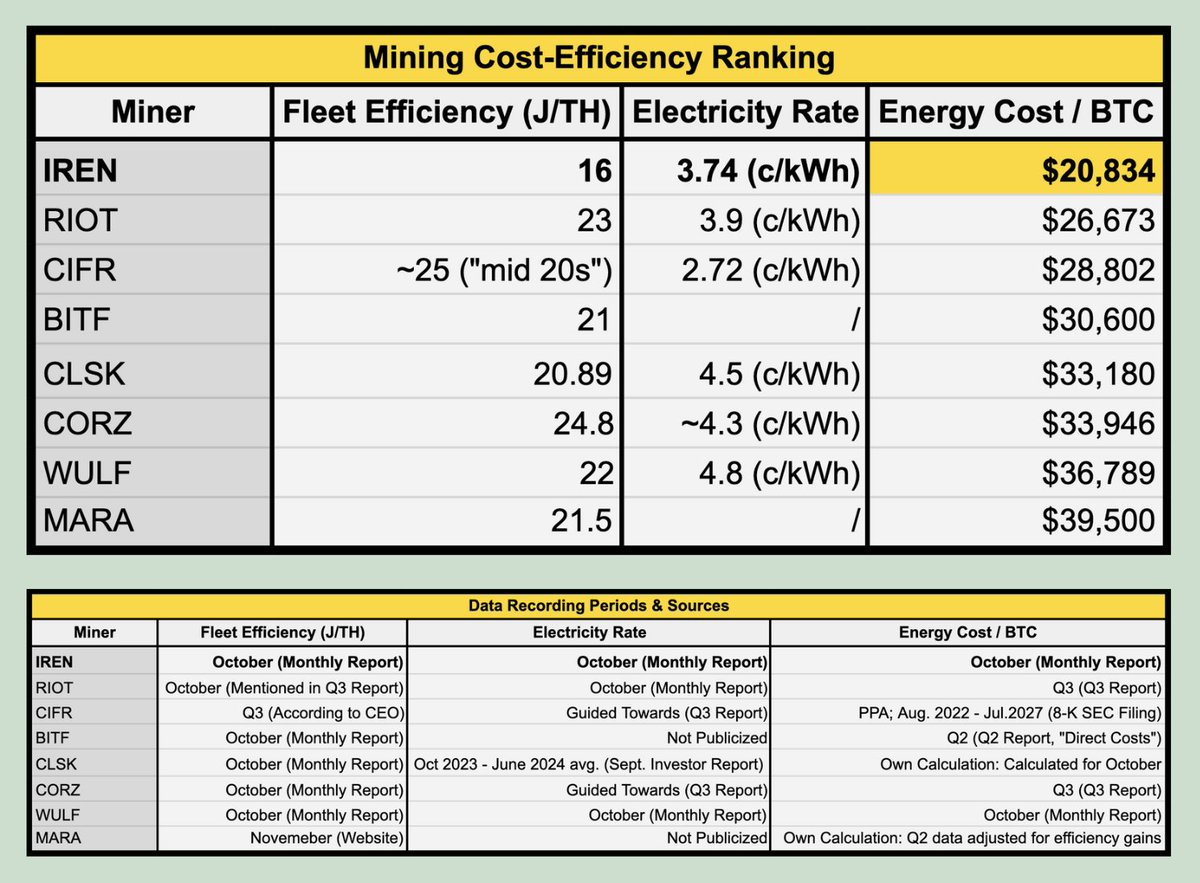

) and went public in November 2021. Based in Sydney, the firm was established with a forward-looking vision to address the growing demand for computing power in an increasingly digitizing world. In its early stages, Iren strategically acquired land in Canada and the U.S., particularly in regions like British Columbia and Texas, where the increasing availability of renewable energy sources such as solar, hydro, and wind is steadily reducing industrial energy costs. As Iren acquired most of its land before the recent AI boom, it's likely they purchased it for a fraction of what it would be worth today, potentially paying pennies on the dollar compared to current market values. This foresight has positioned them exceptionally well for future growth as demand for HPC and AI infrastructure increases and land with access to power becomes ever more scarce and valuable. The company currently holds a very impressive land & power portfolio, consisting of infrastructure sites with grid-connected power capacity of >2.3 GW across the U.S. and Canada, with over 1 GW of additional capacity in the pipeline. To put this into context, in 2023 the TOTAL global data center capacity was approximately 33 GW, according to a report from Citi Research. However, a significant portion of Iren’s infrastructure portfolio remains undeveloped, with the company currently operating approximately 450 MW of data center capacity. Iren is actively scaling its operations, rapidly expanding its capacity by developing its land and constructing new data centers at a rapid pace of 50 MW per month. By the end of the year, [$IREN](https://x.com/search?q=%24IREN&src=cashtag_click) aims to reach 510 MW of available infrastructure, with the majority of this power dedicated to Bitcoin mining at a hash rate of 31 EH/s— positioning the company as one of the largest [$BTC](https://x.com/search?q=%24BTC&src=cashtag_click) miners in the industry. In case you are new to the Bitcoin mining sector, hash rate (measured in EH/s) is a measurement of computational power being used to mine Bitcoin. Generally speaking, the higher the hash rate, the more [$BTC](https://x.com/search?q=%24BTC&src=cashtag_click) you mine. Since there is a predetermined number of [$BTC](https://x.com/search?q=%24BTC&src=cashtag_click) being issued per “block” (every ~10 minutes), [$BTC](https://x.com/search?q=%24BTC&src=cashtag_click) miners compete for this reward. The higher the hash rate, the higher the cut of that reward. This makes EH/s growth imperative for every miner. Achieving the end-of-year target of 31 EH/s would set a new industry record for the fastest hash rate growth in a single year by a public BTC mining company, both in nominal and percentage terms. This would mark a leap from 5.64 EH/s in January 2024 to 31 EH/s by December 2024, representing a ~450% increase within just one year. [$IREN](https://x.com/search?q=%24IREN&src=cashtag_click) already holds the previous record for the fastest-growing Bitcoin miner in a single year, having increased its hash rate from 1.6 EH/s to 5.6 EH/s last year. This represented an impressive 250% growth rate. However, surpassing this record at such a larger scale would be unprecedented and truly groundbreaking in the industry. This company is quickly establishing itself as the fastest growing [$BTC](https://x.com/search?q=%24BTC&src=cashtag_click) miner of all time with unparalleled growth rates, largely thanks to already owning high quality land on which it can rapidly build its data centers. Given its fast growth, most of Iren’s mining fleet is equipped with the latest hardware this industry offers. This newer hardware translates into higher energy efficiency and, consequently, lower energy costs. As of today, Iren's fleet operates at an industry leading efficiency of 16 J/TH, which is significantly better than the industry average, which ranges in the low-to-mid 20s. By year-end, the company aims to achieve a fleet efficiency of just 15 J/TH, solidifying itself as the most profitable [$BTC](https://x.com/search?q=%24BTC&src=cashtag_click) miner in the industry. The company has also recently dipped its toes into the AI market, offering a small yet promising AI cloud service, which includes 816 [$NVDA](https://x.com/search?q=%24NVDA&src=cashtag_click) H100 GPUs and a recent acquisition of 1,080 H200 GPUs. While [$IREN](https://x.com/search?q=%24IREN&src=cashtag_click) continues to rapidly gain market share in the BTC mining space, the company is now leveraging this success to strategically position itself for emerging opportunities in the AI sector, aiming to monetize a significant portion of its expansive land and power portfolio in this growing segment.

## Infra Portfolio

3) [$IREN](https://x.com/search?q=%24IREN&src=cashtag_click)'s Infrastructure Portfolio

[

](https://x.com/Agrippa_Inv/status/1856779685117452725/photo/1)

After gaining extensive experience in the energy infrastructure sector, the Roberts brothers launched [$IREN](https://x.com/search?q=%24IREN&src=cashtag_click) with a clear focus: finding land with access to the cheapest available energy. Contrary to popular belief, many renewable energy sources are often the most cost-effective forms of energy. This is in part because renewable energy typically generates electricity that must be consumed immediately, as storage technologies are still insufficient (although [$TSLA](https://x.com/search?q=%24TSLA&src=cashtag_click) is slowly changing this). Without sufficient demand, much of this energy goes to waste. In some regions, government subsidies have led to an oversupply of renewable energy, creating a mismatch between supply & demand. Recognizing this market inefficiency, the Roberts brothers strategically sought out data center locations near these renewable energy projects, where providers were keen to supply their power to the local grid at low rates. Canada

[

](https://x.com/Agrippa_Inv/status/1856779685117452725/photo/2)

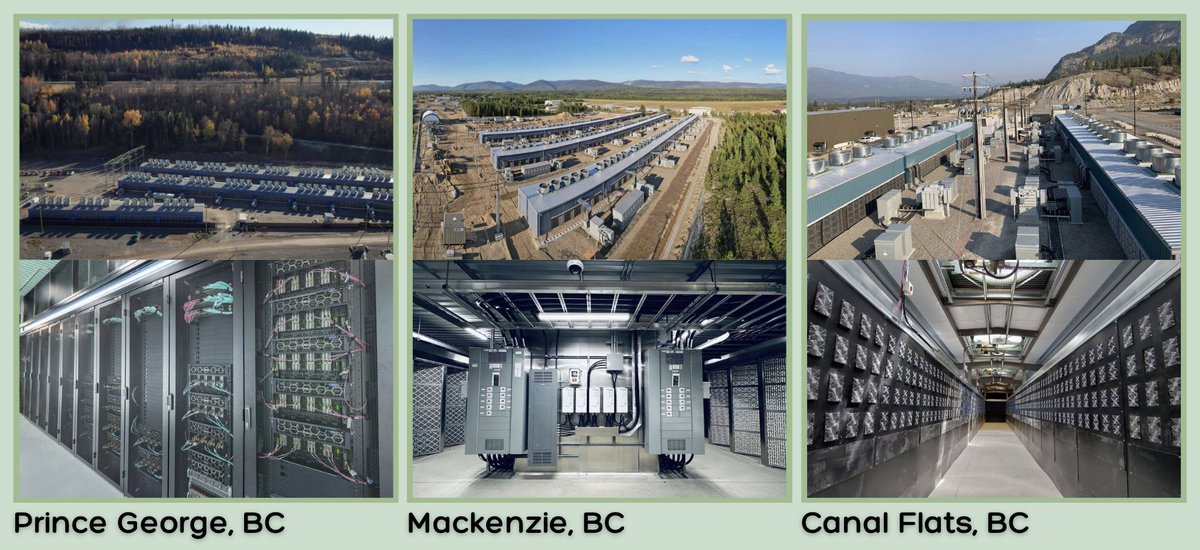

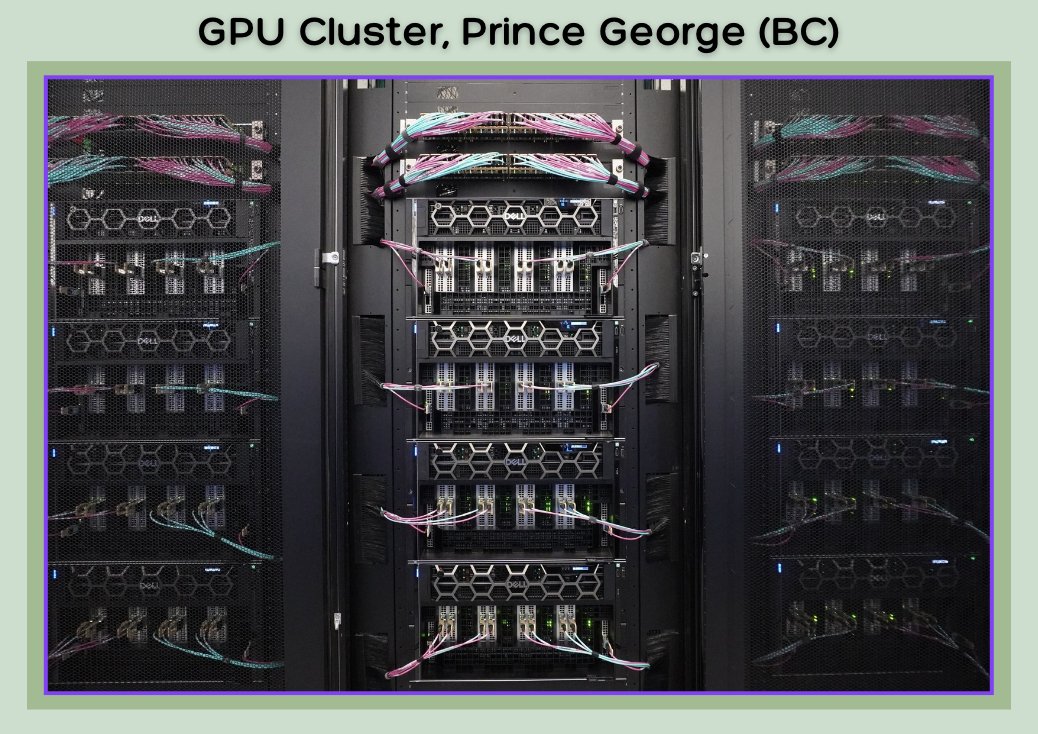

The first site they acquired is located in Canal Flats (30MW / 10 Acres), British Columbia (BC), Canada. This facility was built next to a shutdown pulp mill, taking advantage of the local oversupply of hydroelectric power. The Roberts brothers ‘purchased’ the data center (more on that later) and used the existing infrastructure to support their Bitcoin mining operations. Shortly after the ‘acquisition’ of the first site in Canal Flats, [$IREN](https://x.com/search?q=%24IREN&src=cashtag_click) expanded further by securing 2 additional sites in British Columbia: Mackenzie (80MW / 11 Acres) and Prince George (50MW / 12 Acres). Both locations, like Canal Flats, primarily rely on cheap & renewable hydroelectric power. Prince George is currently being used as Iren's hub for AI computing. The company is also currently conducting power studies with the intention of potentially expanding this site by an additional 20-40 MW. These Canadian sites have electricity rates in the mid $0.04 range per kWh, which is decent for commercial purposes but not exceptionally low. All BC sites are grid-connected and receive power from the BC Hydro network (in front of the meter), which is almost entirely hydroelectric. The BC Hydro grid is highly stable, with a reliability rate of 99.931%. Additionally, Iren has installed battery and generator backups for key components such as network, storage, security, and key management systems to ensure redundancy and minimize downtime. The infrastructure sites also have sub-20ms latency, which is more than sufficient for maintaining smooth operations in most AI workloads, specifically in the context of inference. Inference refers to the process of using a trained machine learning model to make predictions or decisions based on new data. For example, when you interact with an AI system like ChatGPT, the model performs inference by processing your inputs in real-time to generate responses. Low latency is crucial in this context because it directly impacts the response time, which ensures a smooth & efficient user experience. High latency would result in noticeable delays, hindering the performance of real-time applications. Texas

[

](https://x.com/Agrippa_Inv/status/1856779685117452725/photo/3)

Following their success in Canada, [$IREN](https://x.com/search?q=%24IREN&src=cashtag_click) expanded into Texas with the massive Childress site (750 MW / ~550 Acres). This site was initially announced to have a capacity of 600 MW but was upgraded to 750 MW in late July this year. The majority of Iren’s growth over the coming year will come from this site, especially regarding their Bitcoin mining operations. Out of the 750 MW capacity, 350 MW will be operational by the end of 2024, with the remaining 400MW scheduled to be operational by late 2025 / early 2026. By the end of this year, Childress will make up about 70% of the company’s built-out MW capacity. Interestingly, Iren states on their website that this site has a size of 420 Acres. However, investment analyst & [$IREN](https://x.com/search?q=%24IREN&src=cashtag_click) investor

[@FransBakker9812](https://x.com/FransBakker9812)

found proof that Childress is actually 553 Acres large and consists of 3 pieces of land. Given the scale of this site, it’s possible that the company has intentions of increasing its capacity yet again, beyond 750 MW. As of now, Childress has one 640 MVA transformer and is set to receive a second one by Q2 2025. This addition will enable Childress to achieve its 750MW capacity, but theoretically speaking, these two transformers could support up to ~1.2 GW. Given the recent upgrade from 600MW to 750MW, one could speculate that the site could potentially reach 1-1.2GW in the future. However, it’s worthwhile noting that any additional expansion beyond 750MW at Childress would likely be contingent on securing new connection agreements & getting approved by ERCOT (Texas grid operator). Similar to Iren's Canadian site, the Childress facility is grid-connected, drawing power from the AEP network which has a reliability rate of 99.957%. To ensure redundancy, like all of Iren’s sites, Childress is equipped with backup generators and battery systems, which provide additional resilience and minimize the risk of downtime. Lastly, the Childress facility is connected to dual physical fiber paths, achieving sub-10ms latency, which is considered excellent for AI inference tasks. Iren states that ALL its sites have this level of ‘best practice’ network redundancy, using *at least* two physically diverse fiber paths with multiple tier 1 Internet Service Providers (ISPs). This means that if one ISP or fiber path encounters an issue, such as a physical cable cut or technical failure, the other path with a different ISP can take over, maintaining connectivity. This setup addresses a common concern with rural or remote sites, where connectivity issues are more likely due to fewer infrastructure options compared to metropolitan or city-adjacent sites, which often have more robust network infrastructure. Iren’s approach ensures that its sites are well-equipped to handle these risks, effectively negating this concern and providing reliable, low-latency network performance. 1.4GW West Texas site: Iren’s second site in Texas is the largest asset in their portfolio, featuring a massive 1.4 GW capacity. Currently this site is mostly undeveloped, however, the company has already secured all necessary connection agreements, with the procurement process underway for substantial parts of its infrastructure. This site is very attractive for potential AI colocation / joint venture deals with hyperscalers like Amazon’ AWS, Microsoft’s Azure, Google Cloud, or even Meta. There are not many sites with >1 GW of freed-up energy capacity and there are even less sites of that scale that would be ready to use as early as H1 2026. A colocation deal between a data center host like Iren and a hyperscaler typically involves the hyperscaler renting the host’s infrastructure, while bringing their own compute hardware like GPUs. These arrangements can vary significantly; the host might offer a standard, off-the-shelf setup or build a customized facility tailored specifically for the client’s needs. This flexibility allows hyperscalers to quickly scale their operations using the host’s established infrastructure without having to invest time & money in building their own data centers. As of Iren’s most recent updates, the current target for the energization date of the site’s 1.4 GW substation is in April 2026. It’s likely that Iren would be able to start building data centers already before that date, possibly as early as late 2025 and energize them by April 2026. This H1 2026 energization date is a crucial factor in the context of this site’s value proposition. The world’s largest tech firms are locked in an AI compute arms race, prioritizing rapid scaling and time to market (TTM) as they compete to expand capacity as quickly as possible. For example,

[@elonmusk](https://x.com/elonmusk)

's

[@xai](https://x.com/xai)

recently built its 'Colossus' mega cluster of 100,000 H100 GPUs in just 19 days, with plans to add 50,000 H200 GPUs soon. One could criticize Elon for heavily investing in an older generation of GPUs, like the H100s, when the newer H200 GPUs are gradually becoming more available, and the much more powerful Blackwell generation is being launched next year. However, this decision underscores the critical importance of time to market (TTM). Elon is focused on securing as much AI capacity as soon as possible, and currently, H100s are the most readily available option, even if they are not the latest & best. The top firms know that achieving the most AI capacity earliest is key to dominating this new market and securing a potentially unassailable lead. One of the constraining factors that is becoming increasingly more prominent, as the scale of AI clusters increases, is access to power. The new generation of AI purposed GPUs require much more energy than traditional data center hardware. Access to power is rapidly becoming a scarce commodity. Keep in mind that, as mentioned earlier, the global data center capacity in 2023 was ca. 33 GW, with most of it dedicated to well-established needs such as hosting, file storage, and other enterprise cloud services. While some of this capacity will inevitably be adapted for AI compute, it's unlikely to be a substantial amount, as these traditional services remain critical and continue to drive significant demand. Thus, most of the new AI capacity coming online will require new access to energy. The challenge with this is that developing greenfield sites for data centers is a complex, multi-year process that often takes upwards of 5 years to become operational. This process consists of:  Site Selection and Due Diligence (1-2 years)  Power Studies and Connection Agreements (1-2 years)  Permitting and Construction (2-3 years) [$IREN](https://x.com/search?q=%24IREN&src=cashtag_click) had the foresight to not only acquire the massive 1.4 GW site in west TX years ago, but also start the process of conducting power studies and getting connection agreements / permits well in advance. Having such a large quantity of new, unpurposed, power available as early as 2026 makes this a true ‘unicorn’ site in this new era of compute. [$IREN](https://x.com/search?q=%24IREN&src=cashtag_click) recently clarified that it has the procurement process underway for 4 x 560 MVA 345 kV/138 kV transformers. This provides the company with plenty of optionality in terms of redundancy and potential for energy expansion beyond 1.4 GW. Four x 560 MVA transformers would provide enough energy for 2240 MW. However, it's unlikely that the site will increase capacity to beyond 2 GW without adding additional transformers. One must understand the importance of redundancy in the context of HPC cloud hosting. This site’s current set-up of transformers would be sufficient for a T3 facility of 1120 MW (1.12 GW) - whereby two 560 MVAs would be in use and two are on standby for redundancy purposes. In the data center industry, uptime & redundancy are classified into four tiers, with Tier 1 being the most basic level and Tier 4 representing the highest level of redundancy and fault tolerance. Tier 3 (T3) is generally considered the standard that most hyperscalers strive for. T3 facilities must provide N+1 redundancy, meaning they have at least one backup component for every critical infrastructure element. This ensures that the data center can remain operational during maintenance or equipment failure. In the case of Iren’s new west Texas site, the current setup of 4 x 560 MVA transformers allows for two transformers to be actively used while the other two serve as backups. This configuration supports the N+1 redundancy required for a T3 facility, ensuring that if any of the active transformers fail, the backups can immediately take over without disrupting operations. Alternatively, [$IREN](https://x.com/search?q=%24IREN&src=cashtag_click) could push for higher MW usage at the expense of redundancy, similar to what they did at their Childress site. For instance, they could operate with 3 out of the 4 transformers, providing upwards of 1.5 GW capacity. This setup would sacrifice the N+1 redundancy standard required for T3 status but would likely still qualify for a T2 facility, as it maintains basic redundancy with one transformer on standby. I would also like to point out that while redundancy is a critical factor in cloud computing, it’s less of a factor in the realm of Bitcoin mining. Sure, having high uptime is detrimental to mining revenues, but having occasional outages isn’t going to break the camel’s back. You are not going to upset any customers when maintenance work is being done for a couple of hours in your facility, because you have no customers. This is why a facility like Childress, which is primarily being built for the purpose of mining [$BTC](https://x.com/search?q=%24BTC&src=cashtag_click), can get away with less redundancy. In any case, their current setup offers plenty of optionality, allowing them to balance between maximizing capacity and maintaining redundancy based on operational needs. Besides the site's massive scale and short-dated availability, making it an attractive option for colocation deals, the site also has exceptional latency of under 10ms (just as Childress) with multiple fiber paths & tier-1 ISPs . Located in Texas, the site also benefits from some of the lowest energy rates in the country, making it especially appealing for energy-intensive AI workloads. In later sections of this post, I’ll delve into the financial implications of colocation arrangements, focusing specifically on how they impact cash flow dynamics for [$IREN](https://x.com/search?q=%24IREN&src=cashtag_click). Texas & Declining Energy Costs As it relates to declining energy costs, Texas is arguably one of the most promising locations on earth, certainly within the U.S. It already ranks among the 5 cheapest energy states in the US, however, this position is further strengthened by rapid growth in wind and solar power, coupled with significant investments in battery storage. These developments will play a crucial role in driving prices even lower over the coming years. Solar energy is currently the cheapest source of energy, even outperforming traditionally cheap sources like nuclear, coal, and natural gas from fracking. If you doubt this claim, I strongly encourage you to check out the research published by

[@tonyseba](https://x.com/tonyseba)

(especially his presentations on YouTube). As Elon Musk once said: “Once you understand the Kardashev Scale, it becomes utterly obvious that essentially all energy generation will be solar. Just do the math on solar on Earth and you soon figure out that a relatively small corner of Texas or New Mexico can easily serve all US electricity.” Texas also benefits from the free-market dynamics of its unique electricity market, where competition among providers drives innovation and efficiency. ERCOT, the grid operator for most of Texas, manages real-time electricity supply & demand, allowing prices to be set based on market conditions. This system makes it relatively easy for companies to develop projects like solar farms and sell their generated electricity to the grid, thanks to clear market regulations and streamlined processes. Moreover, Texas is now moving towards a system that allows private companies to compete for building the transmission network, which could further accelerate energy cost declines in the state. Traditionally, transmission development in Texas has been more restricted. The right-of-first-refusal (ROFR) law gave established utility companies the exclusive right to build new transmission lines, which meant that other companies couldn't compete for these projects. However, a recent court ruling deemed this law unconstitutional, opening up transmission projects to competition. This change allows private companies to bid on building transmission lines. By introducing competition in this part of the market, the ruling could lead to more efficient and cost-effective infrastructure development. Just as the free-market model for electricity generation has driven innovation and kept prices competitive, this new approach to transmission development could further lower costs and speed up the expansion of the grid to meet growing demand. The benefits of Texas’ energy landscape are evident in Iren’’s Childress site, which has a historical average spot cost of just 3.5 cents per kWh, which is significantly lower than the energy costs of most competitors. For instance, Bitcoin mining competitor [$CLSK](https://x.com/search?q=%24CLSK&src=cashtag_click), primarily operating in Georgia, faces average costs of ~ 4.5 cents per kWh. Similarly, [$WULF](https://x.com/search?q=%24WULF&src=cashtag_click), with operations in New York and Pennsylvania, incurs rates ranging from high 3s to high 4 cents per kWh. As a reference point, the miner with the industry’s lowest electricity rates is [$CIFR](https://x.com/search?q=%24CIFR&src=cashtag_click), with a cost of just 2.72 cents per kWh. However, this low cost comes from a long-term Power Purchase Agreement (PPA), (set to expire on July 31, 2027), that requires them to curtail up to 5% of their energy use annually. This drawback effectively reduces their operational days and thereby its revenue potential & usability for AI workloads that require constant uptime. Although Iren’s average spot rate at Childress was just 3.5 cents per kWh from April 2023 to July 2024, the company ended up paying a realized price of 4.3 cents per kWh during this period, due to its use of hedging strategies to mitigate price volatility. However, this changed in August 2024, when the company shifted its approach to primarily using spot pricing, by leveraging the favorable rates in Texas and the flexibility to curtail operations during brief periods of volatile price spikes. This new strategy allowed the company to secure remarkably low energy costs for its Bitcoin mining operation in Childress, with rates of just 3.1 cents per kWh in August, 3.2 cents per kWh in September, and just 3.06 cents per kWh in October. The fact that Iren’s electricity rates for the past 3 months were significantly lower than the average of 3.5 cents suggests that energy prices in Texas are trending downwards. This trend is likely due to the increasing deployment of solar and battery storage. As a result, over the next nine months leading up to summer, [$IREN](https://x.com/search?q=%24IREN&src=cashtag_click) could potentially achieve average electricity rates in the high 2 cent range to low 3 cent range per kWh at their Childress site. In the realm of Bitcoin mining and AI compute, where margins are primarily influenced by energy costs and mining efficiency, this would act as a significant cost advantage and tailwind for rising margins. However, I do want to point out that, generally speaking, average electricity rates will likely always be cheaper if you have the optionality to curtail when prices spike. Curtailing involves temporarily shutting down operations for a few hours or even several days when electricity prices surge unexpectedly, often due to grid instability. Usually, you only have this sort of optionality in the realm of Bitcoin mining and not in the (AI/HPC) cloud computing market where constant uptime is required. This means that while I do expect Iren to achieve electricity rates as low as $2.5-3 cents per kWh at their TX sites, I think this will mostly be in regards to their mining operations. In the AI cloud segment, I expect energy rates to be closer to 3-3.5 cents per kWh (at TX), factoring in the occasional pricing spikes that tend to happen from time to time. That being said, the Texas grid is becoming more stable with the deployment of large-scale battery storage, which will enhance network reliability and price stability, leading to fewer sudden pricing spikes over time. Speculative / Undisclosed Sites In addition to the confirmed 2,310 MW of secured power across existing sites, [$IREN](https://x.com/search?q=%24IREN&src=cashtag_click) has stated that they have over 1GW of additional land & power capacity in the pipeline. While the company hasn’t provided much info on this additional ~1 GW pipeline, my good friends

[@FransBakker9812](https://x.com/FransBakker9812)

&

[@Brenno2332](https://x.com/Brenno2332)

discovered that Iren acquired several pieces of land in recent times. They did that by discovering the actual property deeds recorded with the municipality, showing that these sites are indeed owned by the company. According to their research, Iren recently acquired two additional sites in Texas, each approximately 40 acres in size. They also confirmed the purchase of a 159-acre site in the neighboring state of Oklahoma. Moreover, just a few days ago, Frans discovered that Iren recently signed a Memorandum of Contract (MOC), giving them the option to acquire a new 337-acre land site in West Texas, with a 6-month window to exercise the option. Big S/O to Frans & Brenno for doing so thorough due diligence & finding these nuggets of information.

[

](https://x.com/Agrippa_Inv/status/1856779685117452725/photo/4)

In conclusion, Iren is on track to achieve a total capacity of 510 MW by the end of 2024, and with the continued development of the Childress site, this capacity is expected to expand to 910 MW potentially as early as 2025. Not only is their ambitious 1.4 GW project set to break ground shortly before April 2024, with a potential start as early as late 2025, but they also have over 1 GW of additional capacity in development. CEO Dan roberts confirmed that Iren is currently growing its built-out data center capacity by ~50MW / month, far exceeding the industry standard of ~5-20 MW per month. Given this rapid growth rate and the company’s extensive infrastructure portfolio, [$IREN](https://x.com/search?q=%24IREN&src=cashtag_click) is poised for an unprecedented surge in computing power over the coming years. Iren’s extensive land & power portfolio provides significant flexibility for both Bitcoin mining and its expansion into the AI sector - topics I will explore further in the following sections of this post. For anyone interested in staying up to date with the company’s infrastructure progress, I highly recommend following

[@FransBakker9812](https://x.com/FransBakker9812)

. He provides frequent updates & insights by publicizing satellite images and sharing his in-depth investigative research.

### AI Entry

4) [$IREN](https://x.com/search?q=%24IREN&src=cashtag_click)'s AI ENTRY

[

](https://x.com/Agrippa_Inv/status/1856779693602869531/photo/1)

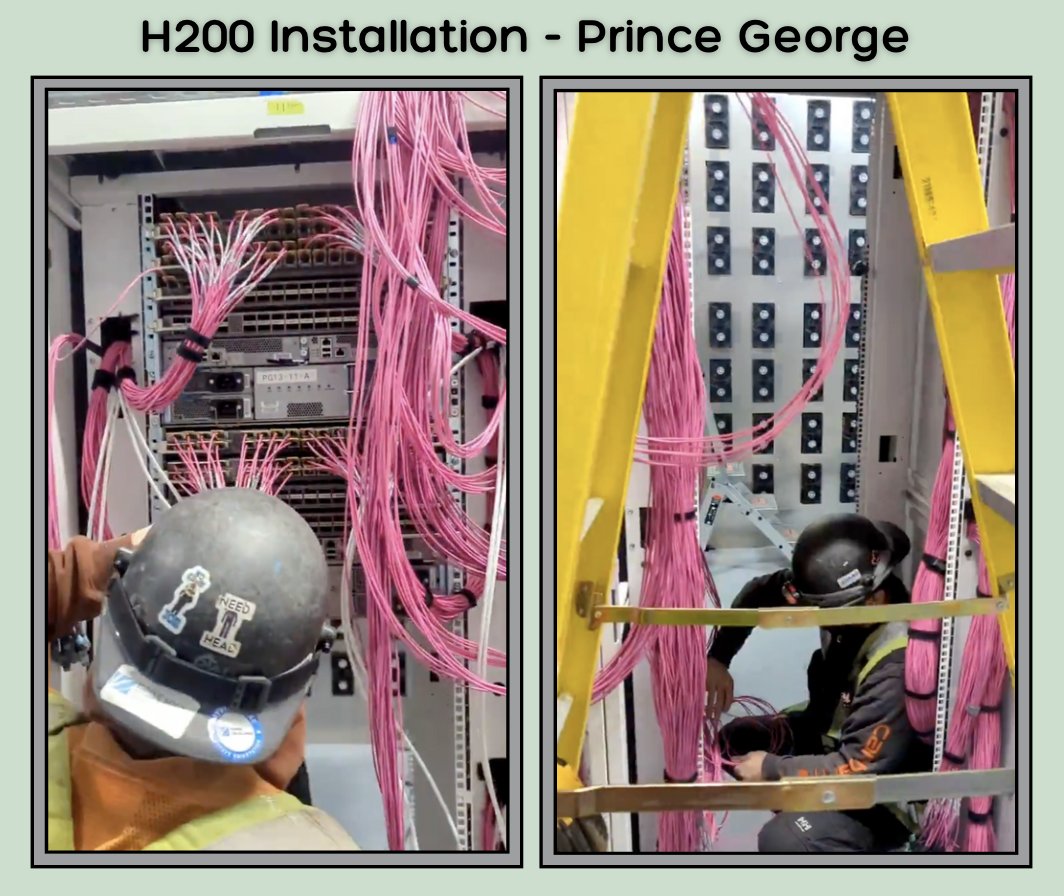

While Bitcoin mining operations currently remain Iren’s primary revenue source, the company is increasingly shifting its focus to high-performance computing (HPC) for AI cloud hosting. It’s worth noting that Iren has publicly expressed its interest in the AI sector since its IPO in late 2021. The company began actively pursuing this strategy roughly a year ago (late August 2023), starting with the acquisition of 248 H100 GPUs from Nvidia. Iren then began scaling its capacity in February of this year, acquiring an additional 568 H100s. Seven months later, in September 2024, Iren purchased 1080 units of the newest H200 generation, bringing their total capacity to 1,896 H100 & H200 GPUs. The recently acquired batch of H200 GPUs is currently being installed at Iren’s Prince George facility, alongside its existing H100s, and is expected to come online in the coming weeks. The company monetizes its GPU fleet through a business model called ‘AI cloud hosting’, which involves renting out the computing power generated by these GPUs to businesses looking to train AI models or run inference tasks. Cloud Service Providers (CSPs) like Iren typically charge for this capacity on a per-hour basis, referred to as ‘GPU hours’. More advanced and powerful GPUs command higher rates per hour, reflecting their increased computational capabilities and efficiency. CSPs typically differentiate themselves based on pricing and service quality. Those who own 100% of their infrastructure—from GPUs to data centers and the land they are built on—and have access to low-cost energy gain a clear cost advantage, allowing them to offer more competitive rates. However, service quality is also crucial; CSPs that provide high redundancy (ensuring no outages), rapid response times for customer requests & modifications, or the option for fast scalability can charge a premium compared to their competitors. Iren, being fully vertically integrated, meets both criteria. By owning all its infrastructure and accessing inexpensive energy, the company significantly lowers its operating costs. This vertical integration also gives Iren complete control over its operations, resulting in excellent response times and high-quality customer service. Iren is quite unique in this regard, as many CSPs rent infrastructure from data center (DC) hosts through colocation deals. In most cases, DC hosts operate the facility for the CSP clients. Typically, the DC host is responsible for the physical infrastructure, including power, cooling, security, and maintenance. The CSP, leases this space and infrastructure but focuses on managing and delivering services to their end clients. In this setup, the CSP often acts as an intermediary (middle-man), providing cloud computing services while relying on the DC host to maintain and operate the physical environment. This arrangement allows the CSP to scale quickly without the overhead of managing the physical infrastructure, while the DC host ensures the facility’s operations remain efficient and reliable. However, this arrangement ultimately results in higher operating costs for the CSP, as the hosts need to make a profit too. Since the host ultimately controls the data centers, this type of arrangement also reduces the CSP’s operational control, which can adversely affect the quality of service towards the end-customers. Moreover, colocation deals can create misaligned incentives for hosts. The host’s primary customer is the CSP, typically secured through long-term contracts. With revenue guaranteed for multiple years, the host’s main incentive shifts towards maximizing profit margins by minimizing costs. This can result in reduced facility maintenance, leading to more outages and repairs over time. Additionally, it may also cause slower response times for the CSP’s customers, whom the host indirectly serves. While this type of colocation partnership has its drawbacks, the primary advantage is that it allows the CSP to scale more rapidly to increase market share (fast TTM), as it avoids the time-consuming process of building its own infrastructure. While Iren won’t operate as a CSP that rents other companies’ infrastructure, they are likely to become a host for other CSPs and hyperscalers, in addition to running their own AI cloud service business. In its recent quarterly earnings call, management stated that they are in active discussions and have signed NDAs with some of the largest companies in the world. Iren also noted in an October business update that there is “indicative interest from hyperscalers”. Thus, a colocation deal materializing appears increasingly likely. The distinction between Iren’s own cloud services and those provided for other hyperscalers would likely be minimal, essentially creating a 'white label' model for CSPs utilizing Iren’s infrastructure. Although this approach might initially seem counterintuitive, it aligns with the priorities of hyperscalers, who primarily focus on time-to-market and rapid scaling. Given Iren’s extensive land holdings and access to energy, it would be impractical for them to utilize all this capacity solely for themselves, as it would require well over $50 billion in GPU investments alone. Colocation agreements would arguably be the most cost-effective way to utilize a large majority of Iren’s energy capacity, allowing them to maximize the use of their resources. One could also argue that a colocation deal with an infrastructure provider like Iren, which operates its own CSP business, is more advantageous for a hyperscaler, as it effectively addresses the ‘incentive problem’ mentioned earlier. Iren’s dual role as both a CSP and a host for other CSPs means that maintenance and customer support standards are likely to be consistent across both services, functioning as a true white-label business. If discrepancies arise, such as Iren prioritizing its own CSP business over its colocation clients, the hyperscaler may have legal grounds to sue, especially if the agreement stipulates identical levels of service. This arrangement significantly mitigates the risk of misaligned incentives. Moreover, owning a CSP business that Iren plans to scale rapidly over time gives the company invaluable experience in both building AI/HPC data center infrastructure & in providing great customer service - crucial skills for effectively hosting hyperscalers. Hence, while Iren’s own CSP business segment shows promising potential due to its full vertical integration, this also strategically positions the company for future colocation deals with hyperscalers. [$IREN](https://x.com/search?q=%24IREN&src=cashtag_click)'s Data Centers Given the similarities between BTC mining and AI processing—both being highly energy-intensive forms of compute—Iren didn’t have much difficulty in repurposing existing Bitcoin mining infrastructure to accommodate the newly acquired GPUs at its Prince George facility. Recently, CEO Dan Roberts shared a video online showing Iren staff installing the H200 batch in a data center with BTC mining ASICs visible in the background (right pic), indicating that both GPUs and BTC miners are operational within the same data center unit.

[

](https://x.com/Agrippa_Inv/status/1856779693602869531/photo/2)

This is primarily possible thanks to Iren’s high quality data center design. Iren’s modular DC design is almost “over-kill” for Bitcoin mining purposes. Iren is known for having some of the highest infrastructure costs per MW in the Bitcoin mining industry, totalling $650k per MW, which is at least 20-30% more expensive than its peers. While much of the [$BTC](https://x.com/search?q=%24BTC&src=cashtag_click) mining industry resorts to cost-cutting methods like repurposing old shipping containers, renting existing facilities, or acquiring failed mining sites to house their ASICs (mining hardware), Iren distinguishes itself as one of the few miners that has consistently built its data centers from scratch, usually beginning with greenfield sites. As a result, [$IREN](https://x.com/search?q=%24IREN&src=cashtag_click) achieves some of the best uptimes in the industry. By housing ASICs in optimal conditions—ensuring perfect cooling and maintaining dust-free environments—Iren’s BTC mining operations experience virtually no outages, a rare accomplishment in an industry where interruptions are very common. Another trait of Iren’s data centers is their high level of standardization. As mentioned earlier, Iren is currently expanding its capacity at an exceptional speed of 50 MW per month. This rapid growth is largely due to their standardized design and consistent construction methods, which not only accelerate the build process but also maintain consistent quality across all sites. Iren’s data centers have an average Power Usage Effectiveness (PUE) of 1.05, indicating extremely high efficiency. PUE measures how efficiently a data center uses energy, with 1.0 being the theoretical best, meaning all energy is used directly for computing power, and none is wasted. Iren can achieve such a low PUE because it perfected the method of air-cooling. Most modern day HPC data centers use liquid cooling since that is widely regarded as the more effective cooling method, however, that comes at the expense of more energy usage & consequently a worse (i.e., higher) PUE. Nonetheless, Iren engineered a way to maximize the effectiveness of air cooling. The company optimized their cooling design to such an extent that it achieves a rack density of 70-80 kW for their H100 GPU set up. Rack density refers to the amount of power consumption per rack in a data center. It indicates how much computing power is concentrated in a single rack, measured in kilowatts (kW), and helps determine the cooling and power requirements for the facility. As a reference, most modern day data centers operate under a rack density of 5-15 kW. However, as AI computing requires more energy, much more kW are required per rack. NVIDIA provides a reference rack density of 40 kW for their H100 GPUs. Iren achieving a rack density of up to 80 kW in their air-cooled data centers is an engineering marvel. Typically, air-cooled data centers can reach a rack density of around 15 kW, with highly advanced setups usually maxing out at 25-30 kW per rack. Achieving 70-80 kW through the use of air cooling alone is extremely rare and highlights Iren’s engineering expertise. Keep in mind, when Iren repurposed their existing mining facilities to house GPUs, they did so without making any upgrades to the infrastructure. They simply unplugged the ASICs and plugged in the GPUs (along with the other AI-related hardware). This seamless transition is a testament to the quality and flexibility of Iren’s standardized data center design. Nonetheless, next-generation AI hardware & potentially new-gen Bitcoin mining hardware will likely have increasingly higher thermal outputs which would make liquid cooling a necessity. Some investors (such as

[@CulperResearch](https://x.com/CulperResearch)

) have raised concerns about Iren’s ability to implement liquid cooling at their Texas sites, due to the lack of nearby natural water sources. Traditionally, data centers have relied on open-loop cooling systems, which require a continuous external water supply, often sourced from lakes or rivers. Recently, however, closed-loop liquid cooling solutions have emerged as the most efficient cooling method for large-scale HPC facilities.These systems often consist of a mixture of water & glycol and are far more water-efficient than open-loop setups. Unlike open-loop systems, where substantial amounts of water are lost to evaporation, closed-loop systems continuously recirculate the same fluid, with only a minimal top-up required of around 1% per year. This makes closed-loop cooling a far more sustainable & efficient option that significantly reduces water consumption and waste. Iren has publicly announced that they are actively exploring closed-loop liquid cooling systems and have already initiated procurement to accommodate liquid-cooled hardware, including GB200 GPUs, at their existing data centers in Prince George and Childress. The GB200 is a superchip in NVIDIA’s upcoming Blackwell lineup, combining two B200 GPUs with a Grace CPU for maximum AI and HPC performance. It significantly outperforms a standard B200 GPU, offering up to double the processing power and memory bandwidth, making it ideal for large-scale AI model training and inference. Iren’s modular data center designs make upgrading current facilities and retrofitting older sites with closed-loop liquid cooling pretty straightforward. Based on conversations I had with industry experts, this approach is entirely feasible at their current facilities. Given Iren’s expansive land & power portfolio—including a massive 1.4 GW greenfield site—retrofitting existing sites becomes less relevant over time for their AI related HPC data centers. Iren can simply build new facilities with liquid cooling being the go-to cooling method, while maintaining their air-cooled data centers for [$BTC](https://x.com/search?q=%24BTC&src=cashtag_click) mining. If newer Bitcoin mining hardware eventually requires liquid cooling, retrofits can be implemented as needed. Lastly, Iren's current data centers are closer to Tier 2 (T2) facilities than the high-end Tier 3 (T3) standard commonly seen in the industry. As previously mentioned, T3 facilities are characterized by very high redundancy, ensuring N+1 redundancy for all critical systems. While Iren’s BTC mining data centers achieve excellent uptime, their redundancy levels are not on par with T3 facilities. The nature of BTC mining allows for cost efficiencies by avoiding the high energy consumption and infrastructure costs associated with T3 redundancy. However, redundancy becomes more important when providing AI computing services to external clients who expect seamless, reliable operations. Iren’s executives have publicly debated whether T3-level redundancy is necessary for all AI HPC facilities, but they have also affirmed that Iren can enhance power redundancy and resilience at all its sites, achieving T3 level if needed. Adding this extra redundancy certainly seems to be feasible, especially if a large hyperscaler client requires it for a colocation deal.

[

](https://x.com/Agrippa_Inv/status/1856779693602869531/photo/3)

PodTech co-founder & strategic [$IREN](https://x.com/search?q=%24IREN&src=cashtag_click) shareholder:

[@brianfry01](https://x.com/brianfry01)

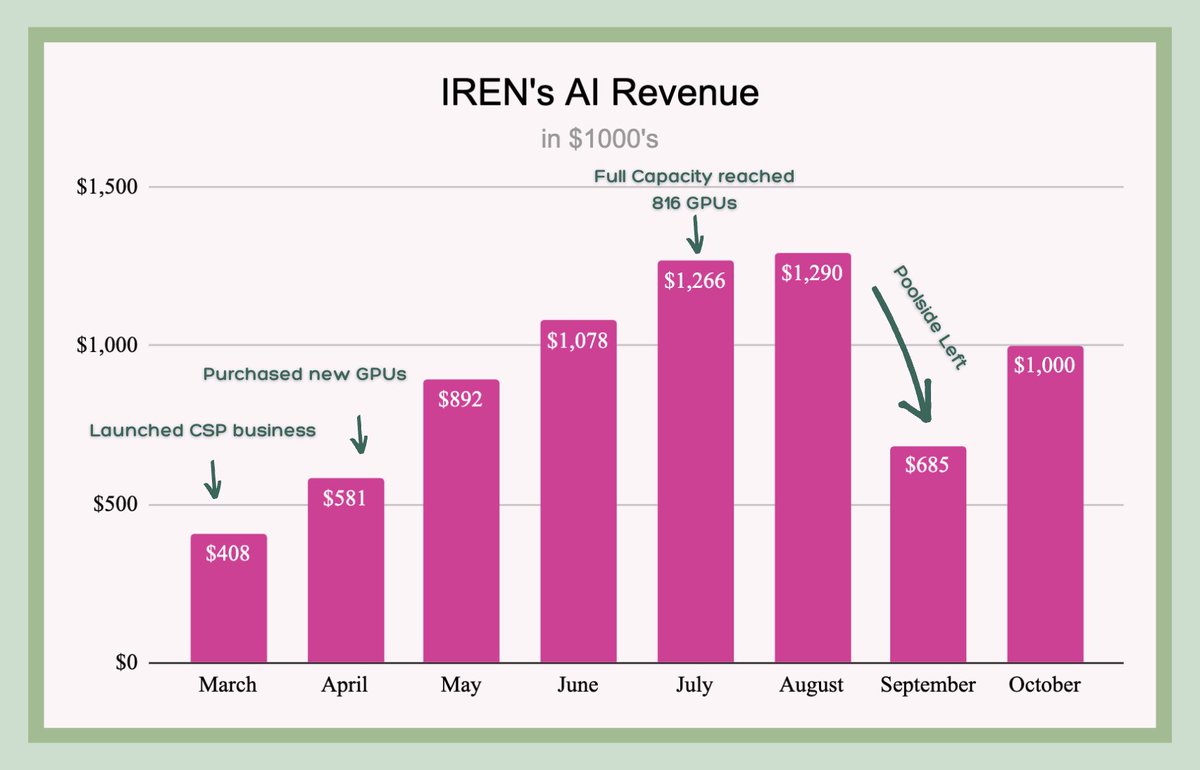

[$IREN](https://x.com/search?q=%24IREN&src=cashtag_click)'s CSP Growth Timeline Soon after Iren installed its first batch of 248 H100 GPUs, the units were deployed for its first major AI client, Poolside, a startup that develops AI-driven coding tools for software developers. This partnership marked the launch of Iren's new business segment, establishing Iren as a cloud service provider (CSP), in February 2024. Poolside recently raised $450 million, valuing the company at around $2 billion. Two weeks after launching its cloud segment with its first client, Iren tripled its AI compute capacity & purchased an additional 568 H100 GPUs, reaching a total capacity of 816 GPUs. Very content with the service, Poolside quickly upscaled its contract from the initial 248 GPU capacity to 504 GPUs. Poolside even went as far as praising Iren publicly at the ‘NVIDIA GTC 2024 AI’ conference back in March of this year, claiming that they provided the best service out of the ~8 cloud providers they’ve tested. By July, Iren filled the remaining capacity with several smaller clients, reaching full utilization of their 816 GPUs. However, Poolside and Iren parted ways in September. This move followed Poolside's $450 million funding round and was likely driven by their need for a significantly larger AI cluster, possibly requiring thousands of GPUs—well beyond what Iren could provide at the time. Nonetheless, 2 months later, Iren managed to close most of the hole Poolside left. The company now boasts an impressive revenue growth of 145 %, growing its AI driven top line from $408k to $1 million in a span of 8 months. While most of this growth occurred between March - July, the recent 1080 large H200 acquisition sets the company up for a promising growth path over the coming months.

[

](https://x.com/Agrippa_Inv/status/1856779693602869531/photo/4)

As Iren prepares for the upcoming Blackwell generation of GPUs and incorporates closed-loop liquid cooling into their data center designs, the company faces multiple strategic options within the evolving AI-HPC market. On one hand, Iren could continue expanding its own fleet of GPUs, potentially accelerating growth through GPU financing and turning its CSP business into a true flywheel. On the other hand, the company could secure colocation deals with hyperscalers, acting as infrastructure hosts for much larger CSPs. Given the scale of Iren’s access to power, it’s likely they will pursue both strategies simultaneously. The financial implications for this relatively small company pursuing either of these two avenues could be significant. In the next section, I will explore the financial impacts of these strategies in great detail.

### AI financial metrics and models

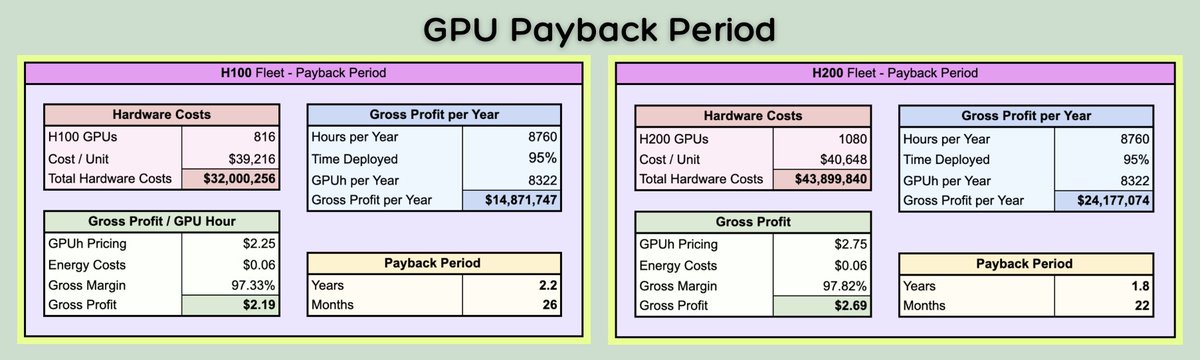

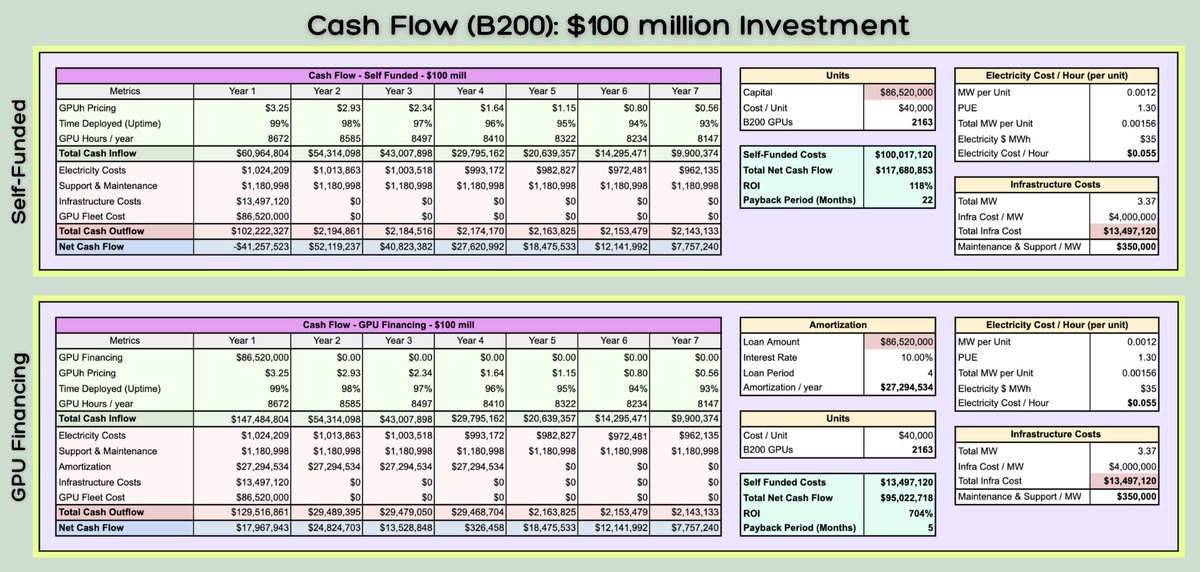

While [$IREN](https://x.com/search?q=%24IREN&src=cashtag_click) hasn’t yet disclosed pricing on their upcoming H200 units, they currently charge between $2 and $2.5 per GPU hour for their H100 fleet, positioning them as one of the most competitively priced options in the market. In comparison, CoreWeave, one of the largest CSPs, charges in the low to mid $4 range for H100 GPU hours. In my opinion, Iren’s low pricing strategy for its AI cloud services is a smart approach, considering its status as a new entrant in the sector. By undercutting competitors, Iren can gain market share more rapidly and establish its presence in this field. The company’s full vertical integration—owning everything from the land and data centers to the energy and GPU infrastructure—supports this strategy by allowing it to maintain lower operating costs compared to competitors who rely on third-party infrastructure. This setup enables Iren to offer lower prices without significantly compromising its margins, effectively leveraging its cost efficiencies to attract clients and build a sustainable business model. Iren has publicly stated that they anticipate a payback period of approximately 2 years for their H100 fleet. After analyzing their numbers— including hardware costs, GPU-hour pricing, projected electricity expenses, and uptime—I found their estimate to be largely accurate. My calculations indicate a payback period of around 26 months, which closely aligns with their guidance. Interestingly, Iren acquired its recent H200 batch for roughly the same cost per unit as their current H100 fleet. This is likely because the larger order size for the H200 batch allowed them to benefit from economies of scale. The [$NVDA](https://x.com/search?q=%24NVDA&src=cashtag_click) H200 is currently the latest & probably last version of the Hopper architecture (next generation is Blackwell). Given that the H200 is about 50-100% more effective in inference and training, it’s reasonable to expect a higher price per GPU hour compared to the H100. Although we don't yet know Iren’s pricing per GPU hour for the H200, it's reasonable to assume they'll charge at least 10-30% more, given the improved performance of this new GPU. This would give us an estimated pricing range of $2.5- $2.9 per GPUh. Model 1: GPU Payback Period

[

](https://x.com/Agrippa_Inv/status/1856779702150590761/photo/1)

Pricing H100: Used mid point of ($2-2.5 pricing range) = $2.25 Pricing H200: 22% premium relative to H100 pricing = $2.75 Energy Costs per GPUh: Used company’s guidance Cost/Unit: Used company’s reported costs per batch (includes their estimated costs for most other hardware expenses needed to run AI clusters (CPUs, InfiniBand, etc).) Time Deployed: My own estimate (assuming near 90% usage in year 1 & near 100% uptime in year 2+) Keep in mind, the biggest unknown variable and risk in the CSP industry is the useful lifespan and depreciation of these GPUs. While the hardware itself can last at least 5-7 years (in optimal conditions), pricing for GPU hours generally declines for older models as new & more capable generations are released. Nvidia’s track record shows it’s launching a new generation every 2-3 years. The Ampere Generation launched in 2020 with the A100, the Hopper generation (H100 & H200) launched in 2022, and now in 2025 we are getting the Blackwell generation with the introduction of the B200 GPU model. If you’re wondering why Nvidia is launching its next generation with the B200 instead of the B100, it’s due to design flaws that led to the (likely temporary) cancellation of the B100, prompting Nvidia to prioritize the B200 for release. The best case study of GPU pricing power over time is the A100, as it's the oldest AI GPU model. When the A100 launched in 2020, pricing among most CSPs generally ranged between $3 and $4 per GPU hour due to high demand and limited supply. Over the past four years, market prices have dropped by approximately 50%, with current market rates typically between $1 and $2 per GPU hour. However, major hyperscalers like Azure still charge up to $4 per A100 GPU hour, while charging ~$7 per H100 GPUh. It’s also important to note that the A100 had roughly half the hardware cost of the H100, meaning hardware margins remain nearly on par with the H100, even 4 years after its release and 2 years since the Hopper generation entered the market. Any serious cloud service provider (CSP) that invested in A100s 3-4 years ago has likely seen substantial profits by now. Given Iren’s great level of service in combination with highly competitive pricing for H100 GPU hours, I believe the company’s H100 & the estimated H200 rates are unlikely to drop significantly over the coming year. While it's certain that the H100 market rates will eventually decline as the H200 becomes more widely available & the new Blackwell generation rolls out, Iren’s current low pricing offers a solid buffer. Even if a competitor like CoreWeave were to reduce its H100 pricing by 25% (from ~$4 down to $3), they would still be ~33% more expensive than Iren. However, even with some potential diminishing of pricing power over time, I believe it’s still reasonable to expect Iren’s H100 payback period to remain below 3 years. Meanwhile, their H200 batch, acquired at a significantly more favorable price, is likely to achieve a payback period of under 2.5 years. Model 2: CSP Cash Flow Model Below, I present a model featuring two tables. Table 1 illustrates the 7-year cash flow progression for a self-funded $100 million investment of B200 GPUs. Table 2 shows the same investment scenario, but with the use of GPU financing (debt) to fund the purchase.

[

](https://x.com/Agrippa_Inv/status/1856779702150590761/photo/2)

GPU financing is an asset-based loan where companies use the hardware they are purchasing with the debt as collateral. This type of debt typically carries higher interest rates, around 10%, and has shorter terms (often 3-4 years). The advantage for debtors is that it limits risk to the hardware value itself, without jeopardizing the company’s overall financial health. For example, CoreWeave raised $2.3 billion from Magnetar Capital and Blackstone, using newly purchased Nvidia H100 GPUs as collateral to expand their AI infrastructure. Similarly, Lambda Labs secured $500 million from Macquarie Group to acquire additional Nvidia GPUs, leveraging the same model. Cost of Investment In both tables, the total investment cost is $100 million, most of it being allocated to the GPUs (i.e. AI hardware costs). Nvidia CEO Jensen Huang estimates B200 GPU prices between $30,000 and $40,000, likely influenced by order size. For this model, I used the midpoint of this range ($35k). While slightly optimistic given the batch size, it provides a scalable figure for further projections (later models). As Iren’s CSP business grows, its relationship with Nvidia should help secure prices closer to the lower end of future price ranges. I estimate an extra cost of $5k per GPU for hardware expenses needed to set up AI clusters (Networking Infrastructure, Storage Systems, CPUs, Memory), bringing the total cost per unit to $40,000. Acquiring 2,163 units will result in a total AI hardware cost of approximately $86.5 million, which leaves us just enough remaining capital to cover the necessary DC infrastructure expenses for this investment. To calculate the infrastructure cost for building the required HPC/AI data centers, we first need to determine both the total MW demand and the cost per MW of build-out. A full-spec B200 GPU consumes up to 1200 watts, or 0.0012 MW per unit. Due to the high power consumption of this GPU generation, liquid cooling is necessary. Currently, Iren’s air-cooled data centers achieve an average PUE of 1.05, meaning that 5% of the energy used for the computing (AI workload) is used on top for cooling & redundancy. However, liquid cooling is more energy-intensive, and thus I expect the PUE to increase to around 1.2-1.3 to account for both higher cooling demands and increased redundancy. Using the higher end of this PUE estimate, we can calculate the required power for this $100 million setup: 2,163 (Units) x 0.0012 (MW) x 1.3 (PUE) = 3.37 MW. With the planned redundancy upgrades and the shift to liquid cooling, I anticipate that costs per MW will be substantially higher than the $650k/MW for Iren’s current air-cooled data centers. Based on discussions with relevant people in the field, costs are likely to range from $3 million to $5 million per MW. Using the midpoint of $4 million per MW provides a reasonable estimate for this calculation. This leads us to a total infrastructure cost of ~$13.5 million (3.37 MW x $4 mill). Adding the AI hardware cost of $86.5 million, we reach the total investment cost of $100 million. GPU Financing Terms GPU financing typically comes with high interest rates (8-12%) and relatively short payback periods (3-4 years). For this model, I used an interest rate of 10% and a 4-year payback period. While repayment structures can vary, I applied annuity amortization, where each payment covers both interest and principal, resulting in fixed annual payments. Based on these financing terms ($86.52 million, 10% interest, 4 years), the annual payment calculates to $27.3 million, which leads to a total repayment of $109.2 million. [$IREN](https://x.com/search?q=%24IREN&src=cashtag_click) could also potentially secure alternative repayment structures, such as the interest-only with balloon payment method or straight-line amortization. In the interest-only structure, Iren would pay only the interest annually ($8.652 million per year) and then the full principal of $86.52 million as a balloon payment in the final year. This approach results in a total repayment of $121.128 million. While it allows maximum cash flow for reinvestment over the first three years, the large final payment carries more risk. Alternatively, the straight-line amortization structure divides the principal evenly, with interest calculated on the declining balance. This method starts with an annual payment of $30.282 million, decreasing each year, with the final year’s payment down to $23.793 million, totaling $108.15 million over four years. Each approach has its strengths and weaknesses, but all enable a cloud service provider like Iren to scale rapidly with minimal self-funded costs, requiring only the self-funded infrastructure investment of ~$13.5 million to build their own data centers. Cash Inflow The cash inflow over the years depends mainly on the rate of decline in GPU-hour pricing and the uptime (operational hours) of the GPUs each year. For this model, I used a 7-year timeframe, reflecting the expected lifespan of these GPUs. Industry consensus suggests a usable lifespan of 5-7 years, but given Iren's high-quality, AI-specific data centers— which I expect to meet the same quality standards as their BTC mining sites—I anticipate the B200 GPUs will achieve the full 7 years, as they’ll likely operate in optimal conditions. I started with a conservative B200 GPU-hour price of $3.25 for year 1. Given that major CSPs like CoreWeave still charge around $4-$4.5 per H100 GPU-hour and Azure charges up to $4 for A100 GPU-hours, I believe $3.25 is a very conservative estimate that aligns well with Iren's strategy of undercutting competitors. From there on, I anticipate a gradual price decline: a 10% drop in year 2, a 20% drop (of year 2) in Year 3, and 30% annually from Year 4 onward, reaching $0.56 per GPUh in Year 7. For uptime, I modeled a slight decline of 1% per year, starting at 99% in the first year and decreasing to 93% in year 7. This reflects the idea that, in theory, lower GPU-hour prices should sustain demand, helping balance supply & demand. However, achieving this equilibrium price becomes increasingly challenging as demand weakens over time. Companies that respond slowly to these demand drops by keeping prices high are risking reduced uptime, as the misalignment with demand results in lower utilization. Maintaining a dynamic pricing strategy is therefore critical, as it allows Iren to hold uptime relatively steady and thus maximizes the total yearly cash flow & thus ROI. Interestingly, in this model, even with a GPU-hour price of just $0.56 and an uptime of “just” 93%, Iren still generates positive cash flow in the final year and even maintains margins above 75%. This highlights the advantage of full vertical integration, as Iren avoids infrastructure leasing costs, with primary expenses limited to electricity, customer support, and maintenance. Electricity Costs I estimate electricity costs at approximately 3.5 cents per kWh, or $35 per MWh. As detailed in the ‘Infrastructure’ section, I based this figure on the assumption that all AI operations will occur in Texas, where Iren’s largest sites are located and where electricity rates average around 3.5 cents per kWh (without curtailment). Support & Maintenance Costs This category includes both technical maintenance and customer support expenses. Customer support here represents the cost of on-the-ground staff configuring and adjusting AI clusters as needed for clients. Maintenance costs are expected to remain stable at approximately $50k per MW. Support costs, however, vary with churn rates and operational scale. From discussions with industry professionals, support and maintenance expenses should range between $250k and $400k per MW, depending on scale & churn. For a conservative estimate, I used an annual figure of $350k per MW in this model. Model 2: Analysis & Commentary Comparing the light-blue boxes in each table provides us with some key insights. GPU financing requires significantly less self-funded capital, as most costs are covered by debt, resulting in a higher ROI and shorter payback period. However, it also reduces total net cash flow due to debt’s interest. The payback period in the GPU-financed model is just 5 months, as it’s calculated using self-funded costs rather than the full loan term. This approach also influences ROI, which is also based on the self-funded capital, resulting in a much higher return in the financed model. In Table 1 (100% self-funded), Year 1 shows a significant negative net cash flow due to the large initial investment. By contrast, Table 2 (GPU-financed) maintains relatively steady positive cash flow each year, although Year 4 stands out as the weakest cash flow year within this 7-year model. This dip is a result from persistently high amortization costs, which continue as cash inflows gradually slow. If [$IREN](https://x.com/search?q=%24IREN&src=cashtag_click) opted for the aforementioned “balloon-style” amortization, cash flow in Years 1-3 would be substantially higher, but Year 4 would experience sharply negative cash flow due to the final large payment. Alternatively, with “straight-line” amortization, payments would gradually decrease, creating more balanced cash flow over the four years; the initial years, especially Years 1 and 2, would see slightly lower net cash flow but avoid the steep drop-off in Year 4. In my view, GPU financing offers clear financial advantages, though it carries higher risk. If the GPU investment underperforms, debt repayment could become challenging, even with the last-resort option of liquidating assets. This “last-resort" option is far from ideal, as it could disrupt service to existing customers and thus severely damage Iren’s reputation. That said, given the favorable ROI of the GPU financing model, it appears to be a worthy risk, especially for a smaller company like Iren with limited capital. A reasonable approach might be to start with a relatively small $50-100 million loan. This should be manageable even if the GPU investment underperforms, as Iren’s BTC mining operations could potentially cover the debt payments without the need to liquidate the GPUs. After observing initial success, Iren could double down on GPU financing, potentially with much larger amounts, and thus expand the CSP business on a much larger scale. Model 3: CSP Flywheel Model

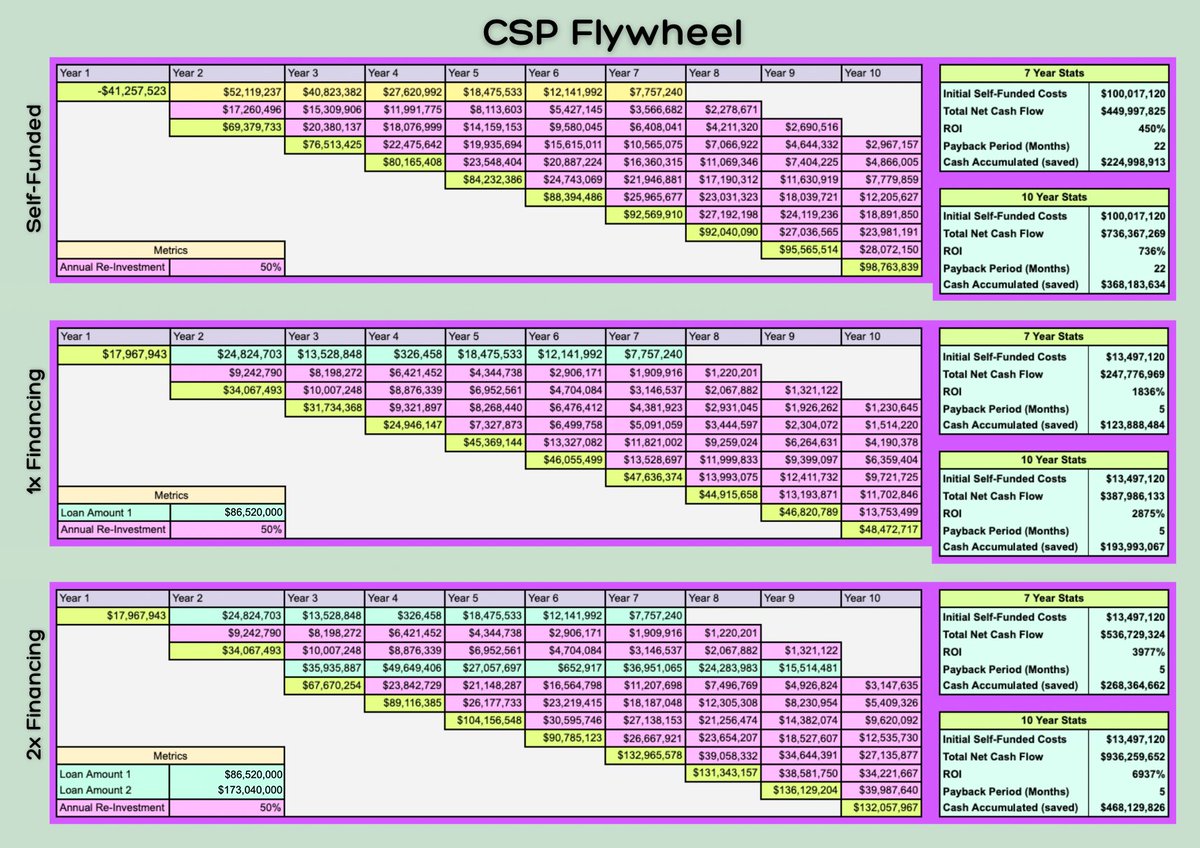

[

](https://x.com/Agrippa_Inv/status/1856779702150590761/photo/3)

The Flywheel model builds upon the 1. model (GPU Cash Flow Model) by demonstrating the compounding effect of reinvesting 50% of each year’s operating cash flow into new GPUs, which, in turn, generate additional cash flow. Operating Cash Flow is defined as net cash flow minus the initial investment expense. This model is, of course, a simplification of reality. In practice, it’s highly unlikely that each GPU purchase will yield identical ROIs and financial performance year after year. Although Nvidia CEO Jensen Huang has stated that Nvidia aims to price its GPUs to allow CSPs to achieve stable ROIs and consistent payback periods, significant fluctuations are inevitable. Predicting supply & demand dynamics with accuracy is challenging, and market conditions, technological advancements, and competitive pressures can all impact the realized returns of each GPU batch. I used a 50% reinvestment rate instead of 100% to showcase how much additional cash can be generated for other purposes, such as investing in other growth avenues like purchasing additional land or even returning cash to shareholders through share buybacks or dividends. This approach of not reinvesting everything into a single 'basket' presents a more balanced and realistic strategy. The 'saved' cash figure can be found in the 7/10-year stats tables to the right of each table under the term 'Cash Accumulated (saved)'. This model includes three tables: Table 1 represents a fully self-funded version with no debt, building on Table 1 from the previous model. Similarly, Table 2 expands on the prior model’s Table 2, illustrating the flywheel effect that could result from a $100 million GPU-financed investment. Table 3 goes a step further by incorporating a second loan, enabling a $200 million investment in the third year. The green fields display the annual net cash flow, calculated as the sum of the fields directly above them. The first row in each table replicates the net cash flow figures from the previous model. Pink fields represent the reinvestment of 50% of the prior year’s operating cash flow. Each of these reinvestment rows projects the 7-year cash flow progression of this reinvested amount, following the same cash flow pattern as in Table 1 (self-funded) from the prior GPU Cash Flow Model. Model 3: Analysis & Commentary Each scenario in this model demonstrates the potential for sustainable cash flow growth well beyond Year 7, when the first batch of GPUs reaches the end of its usable life. In the fully self-funded scenario, a single $100 million investment can yield nearly $100 million in annual cash flow a decade later, with over $350 million accumulated in saved capital over the ten-year span. Interestingly, in the ‘1x Financing Table’, Year 4 avoids a sharp cash flow drop thanks to the additional cash flow generated from reinvested capital in previous years. It’s also notable that the self-funded flywheel generates about twice the total net cash flow over 10 years compared to the 1x financed model. That’s because, in the self-funded case, the first 4 years yield significantly more operating cash flow, thanks to not having to pay any amortization expenses, allowing capital to compound earlier. However, the ‘2x Financing Table’ ultimately takes the lead in returns. Although it carries more risk due to taking on 2 separate loans, this scenario produces the strongest flywheel effect, due to the substantial capital that is deployed in the first three years. Model 4: Colocation

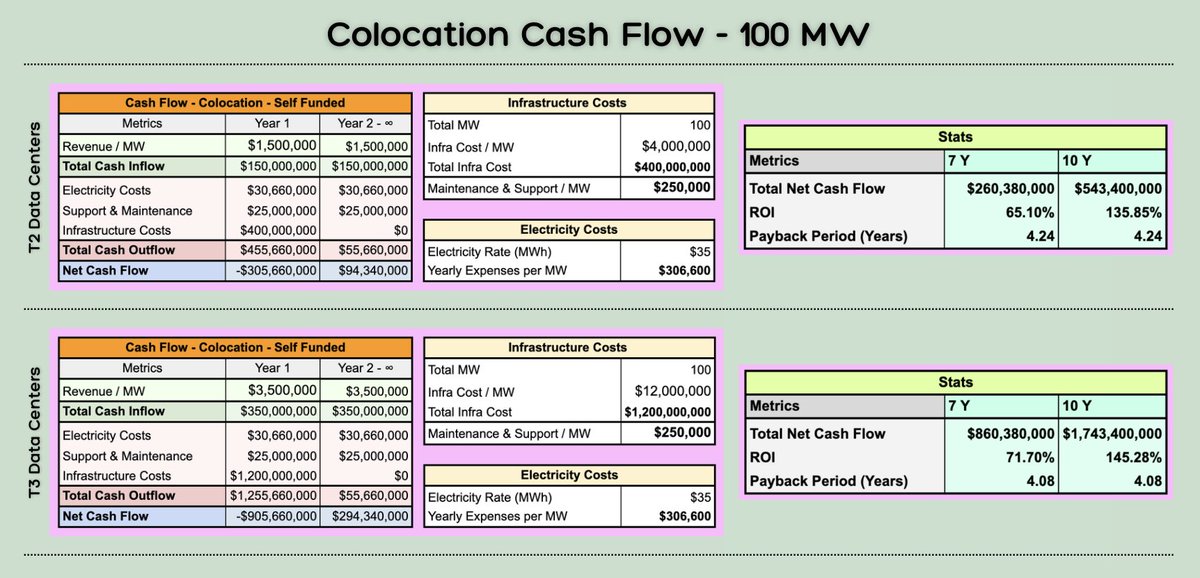

[

](https://x.com/Agrippa_Inv/status/1856779702150590761/photo/4)

This model projects Iren’s potential cash flow per 100 MW of colocation with a large-scale CSP (hyperscaler). It includes two sections: the top section models projections for Iren constructing data centers with liquid cooling and redundancy upgrades but maintaining T2 facility standards. The bottom section explores the scenario of Iren building fully customized T3 facilities to meet specific needs of a major hyperscaler. T2 - Colocation: For the T2 facility projection, I used the same infrastructure cost of $4 million per MW as in previous models, since the data center type remains identical to those depicted earlier. I estimated revenue at $1.5 million per MW, based on a recent colocation deal where Core Scientific ( [$CORZ](https://x.com/search?q=%24CORZ&src=cashtag_click) ), another [$BTC](https://x.com/search?q=%24BTC&src=cashtag_click) miner, agreed to provide 500MW of colocation to CoreWeave at an annual rate of approximately $1.45 million per MW. In this deal, [$CORZ](https://x.com/search?q=%24CORZ&src=cashtag_click) is retrofitting its existing BTC mining data centers at a cost of $1.5 million per MW. Given that this cost is insufficient to develop a full-scale T3 facility, I assume the resulting HPC/AI data centers will likely be T2 standard, with an estimated all-in cost of ~$2 million per MW. Since Iren’s T2 facilities are assumed to be built from scratch (rather than retrofitted) and cost ~$2 million more, their performance is likely superior to CORZ’s DCs. Consequently, I think the $1.5 million per MW revenue figure used in this model is extremely conservative and I wouldn’t be surprised if the actual revenue per MW ends up being higher than even $2 million per MW. It’s also worth noting that Core Scientific recently emerged from bankruptcy in January of 2024, which may have given CW substantial leverage in the negotiation process (low ball offer). Unfortunately, public examples of recent AI/HPC colocation deals are pretty much limited to this one. As previously laid out, maintenance & support expenses are estimated to range from $250k to $400k per MW, depending on scale and churn. For this colocation model, I used the lower end ($250k per MW), considering 100MW is substantial, equating to about 60-65k B200 GPUs with a PUE of 1.3, or roughly $2.5 billion in AI hardware. With a hyperscaler partner, churn is likely low since hyperscalers typically cater to large ‘Fortune 500’ type companies rather than AI startups. Thus, an annual cost of $250k per MW for support & maintenance seems reasonable. For electricity expenses, I applied the same rate as in previous models: $0.035 per kWh. T3 - Colocation The main difference between the T2 and T3 colocation models lies in the higher infrastructure cost per MW and, correspondingly, the higher revenue potential per MW. The cost per MW of $12 million for a T3 facility is based on discussions I had with industry experts, while the estimated revenue per MW of $3.5 million is my own estimate. Some might still consider $3.5 million per MW high, but this would result in a cost of roughly $0.62 per GPU-hour for the hyperscaler (($350 million / (64,200 GPUs x 8,760 hours) = $0.62 GPUh). Given that hyperscalers may charge well over $6 per B200 GPU-hour, an operating cost of less than 10% of its revenue would still yield substantial margins for the hyperscaler. Model 4: Analysis & Commentary It’s pretty clear that colocation offers lower ROI and thinner margins compared to the pure-play CSP model. However, it compensates with secure, long-term income streams. For example, CORZ and CoreWeave agreed on a 12-year colocation deal, providing CORZ with steady, predictable cash flow. For Iren, with its large-scale infrastructure portfolio, it would be impractical to use all this capacity solely for its own operations. Colocation deals, therefore, offer the most effective way to monetize a majority of its available MW capacity. One consideration, however, is the high infrastructure cost involved in colocation. Since Iren would own and operate the infrastructure, it would be responsible for covering these expenses, one way or another. CORZ and CoreWeave addressed this by having CoreWeave, the much larger company, finance the initial infrastructure costs. CORZ then pays off this 'loan' through a 50% reduction in revenue from CoreWeave until the debt is settled. Such a financing structure prevents any single year of negative cash flow, instead spreading reduced cash flows across several years until the debt is repaid. I would expect Iren to employ a similar structure for any colocation agreement. Notably, in the T3 scenario, despite infrastructure costs being 3x times higher than in the T2 scenario, revenue per MW is only about 2.3 times higher. However, the T3 model still has a shorter payback period and higher ROI. This is due to the stable cost of revenue - such as electricity + maintenance & support - which remains consistent across T2 and T3 setups. Consequently, the T3 model achieves higher margins, as fixed expenses stay flat while revenue increases, a benefit referred to as 'operating leverage’. One could argue that T3 facilities might incur higher maintenance costs due to increased redundancy requirements. However, of the $250k per MW in 'maintenance & support' costs, only about 10-20% typically goes towards maintenance, while most is spent on customer support (e.g., staff managing AI cluster configurations). Even with an adjustment for higher T3 maintenance needs, which could add costs of ~$20-30k per MW, would be too marginal to meaningfully impact the bottom line. The operating leverage of the higher-yielding T3 setup would remain in full effect.

### AI wrap up and closing

I want to re-emphasize that the biggest risk to the AI/HPC sector is the potential for GPU-hour prices to decline more rapidly than expected, which would erode ROIs. While gradual price reductions are anticipated and accounted for in my models, the lack of historical data for AI chips makes it difficult to predict the extent of future price drops, posing a risk that the pricing decreases could be steeper than anticipated. This scenario could occur if the supply of AI computing power significantly outpaces demand, leading to more rapid drops in GPU-hour prices. This oversupply could result from both an increase in total GPU availability and advancements in GPU technology, which make newer models far more powerful while depreciating older generations. If GPU-hour prices were to drop significantly more than anticipated in my models, the ROIs for the CSP-related projections would be heavily impacted (to the downside). Additionally, such a scenario would increase the likelihood of large-scale CSPs & hyperscalers re-negotiating terms with their colocation partners, i.e. their infrastructure hosts. This would then also reduce ROIs and alter the projections in my colocation model. Despite the outlined risks, it's crucial to consider the broader market dynamics. The current power crunch, coupled with the growing demand for AI computing, paints a different picture. While there could be an oversupply of GPUs, energy constraints naturally limit how much of this additional compute power can be fully utilized. Even if NVIDIA and TSMC were capable of producing an unlimited number of GPUs, the challenge of insufficient power infrastructure would still persist. Simply put, available GPU supply cannot not be fully utilized without the necessary energy infrastructure. I encourage everyone to watch the brief 1-minute video at the bottom of this chapter, featuring

[@kevinolearytv](https://x.com/kevinolearytv)

explaining the current power shortage affecting the AI/HPC sector. Meanwhile, demand for AI compute is continuously rising. Google recently reported 35% annual growth in cloud revenues, driven largely by its AI-CSP business segment. Given that offering AI services has become an existential matter for many software companies, I believe that demand for AI computing will continue to grow in the coming years. Considering these market dynamics, I remain optimistic that GPU-hour price depreciation following the release of the B200 won’t be too severe for at least another five years, or at least until the current power crunch is alleviated—whether through expanded solar generation or, as some suggest, the development of nuclear energy. Although it’s not my base case, I believe there’s even a reasonable scenario in which compute demand exceeds available supply, causing GPU-hour prices to rise over the coming years instead of decline. In such a case, the likelihood of a temporary market bubble forming in AI-HPC-related stocks would be very high. I've observed that markets often overreact—either by correcting downwards or upwards—when reality turns out to be the opposite of consensus expectations. A scenario where GPU-hour pricing increases instead of decreases could certainly lead to such an event occurring, reminiscent of the surge in 'stay-at-home' stocks, which benefited significantly from sudden shifts in market dynamics during the pandemic. Hence, given all this context, I consider the previously presented financial models to be based on reasonable assumptions that illustrate a highly compelling outlook for Iren's potential in this emerging industry. Through GPU financing, the company could achieve annual pre-tax net cash flows exceeding $100 million within a few years. Alternatively, utilizing its 1.4 GW site for colocation could generate over $1 billion in annual pre-tax net cash flows for T2 facilities and more than $3.5 billion for T3 facilities. Nonetheless, one thing is certain: the CAPEX requirements in this industry are substantial. While Iren is well-positioned with large-scale infrastructure sites and what appears to be ‘abundant’ energy access, it remains a relatively small company with limited cash reserves. Every cent of operating cash flow from BTC mining is reinvested into infrastructure expansion. At this stage in its business life cycle, Iren still depends on external capital to fuel growth. As an [$IREN](https://x.com/search?q=%24IREN&src=cashtag_click) investor, recognizing this is crucial; while the company has immense potential, fully unlocking it will require additional capital. While Iren currently has no debt, I believe it would be wise for the company to consider options such as GPU financing, issuing convertible debt, or initiating a new at-the-market (ATM) offering to raise substantial capital. I want to emphasize that I’m generally not a proponent of corporate debt, as it can hinder a company's agility. Nonetheless, in this CAPEX-heavy industry, taking on debt is almost a necessity, particularly for newer players. With the AI/HPC industry still in its early stages, I believe now is the ideal time for aggressive investment into growth, particularly given Iren’s existing infrastructure setup.

### BTC mining

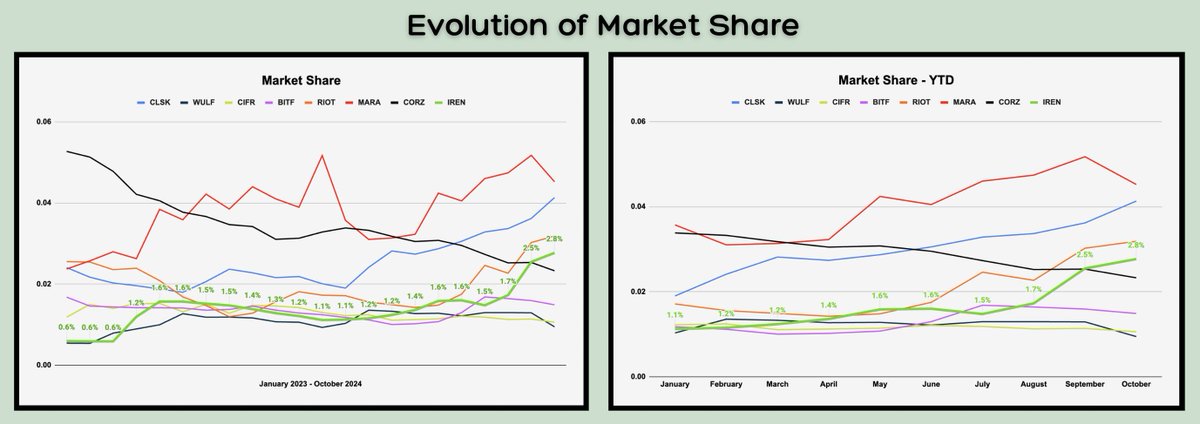

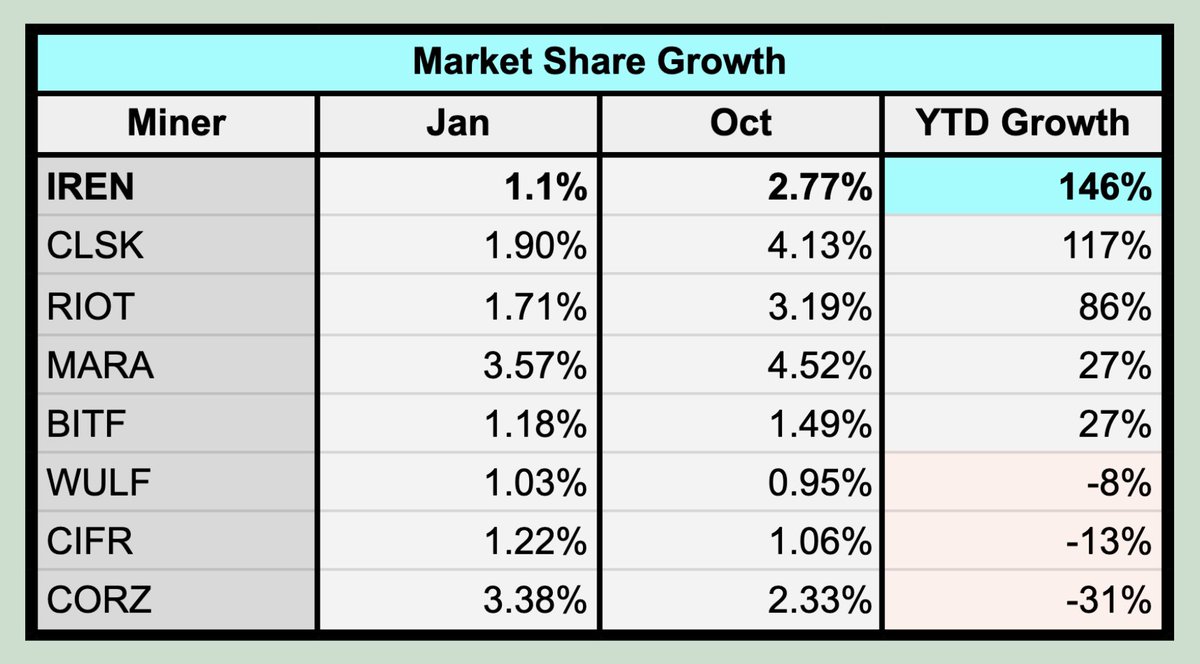

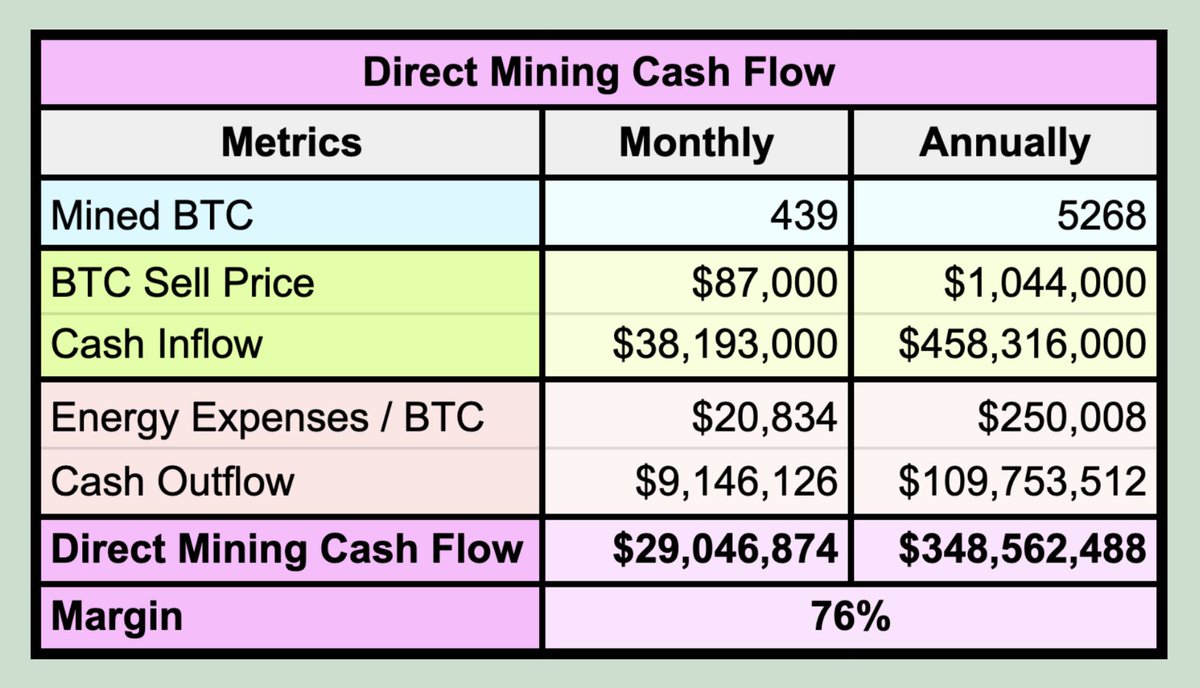

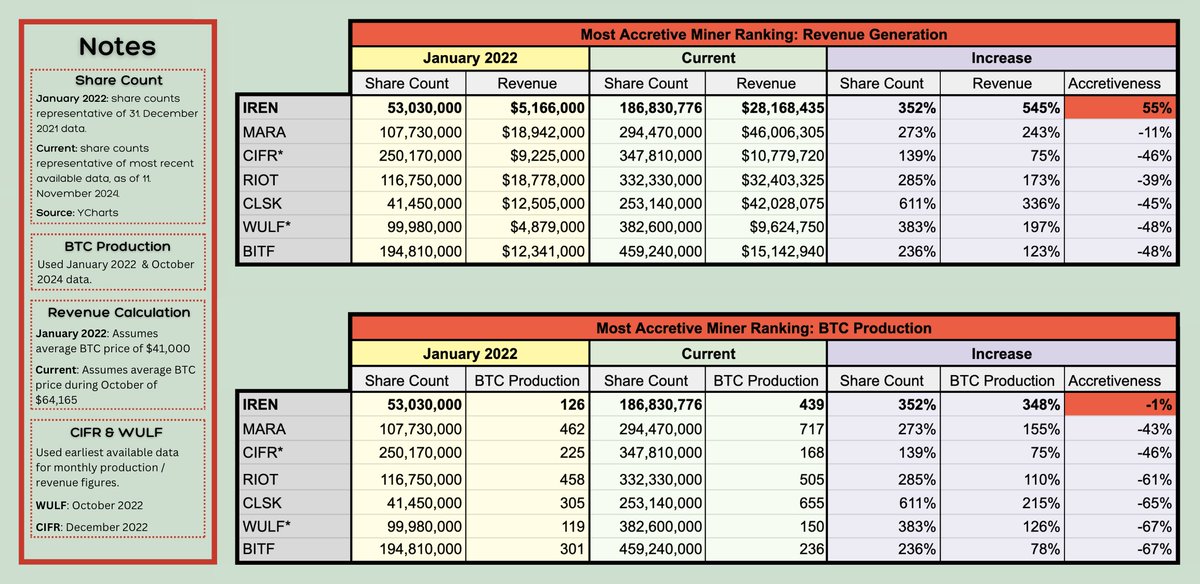

7) [$BTC](https://x.com/search?q=%24BTC&src=cashtag_click) Mining: Unprecedented Growth Iren has rapidly established itself as the fastest-growing Bitcoin mining company in history. In 2023, it set a new industry record by increasing its operating hash rate by an impressive 250% within a single calendar year. However, this record no longer stands, as Iren has once again broken it. Year-to-date, Iren increased its monthly operating hash rate by 14.26 EH/s, growing from 5.64 EH/s in January to 19.9 EH/s in October—a 252% increase that surpasses the company’s previous record. Iren is also not finished for this year, as it plans to install an additional 10 EH/s by year-end, bringing its total installed capacity to 31 EH/s and setting an industry-leading growth rate of over 400%. This exponential increase in computing power has translated into a rapid rise in market share. Back in January 2023, Iren’s market share in BTC mining was a mere 0.6%. Fast forward to today, and that figure has grown nearly fivefold to 2.77%, reflecting a remarkable market share expansion in less than two years.

[

](https://x.com/Agrippa_Inv/status/1856779712460419153/photo/1)

Market share is determined by dividing each miner’s monthly Bitcoin production by the total available BTC rewards distributed globally in that month. These rewards consist of newly issued Bitcoin and transaction fees, both of which are publicly trackable through online tools. While other public miners have also experienced market share growth this year, Iren’s performance stands out.

[

](https://x.com/Agrippa_Inv/status/1856779712460419153/photo/2)

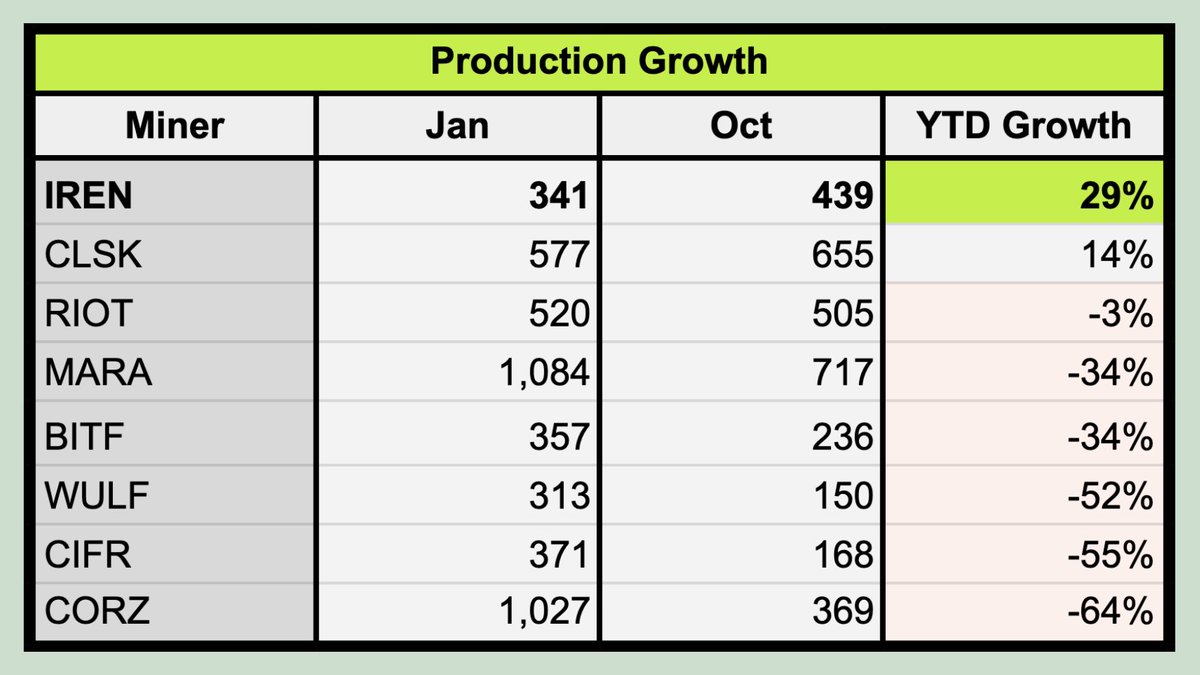

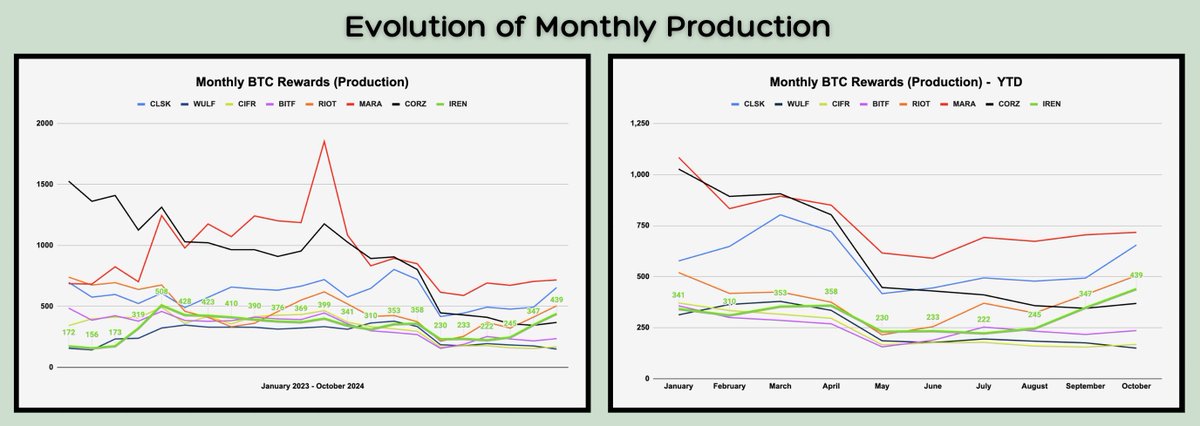

Another noteworthy achievement for Iren is its ability to grow monthly BTC production from January to October of this year, despite the significant challenges posed by the Bitcoin halving event in April. For those unfamiliar, the halving event, which occurs roughly every four years, reduces miners' block rewards by 50%. While transaction fees are unaffected by the halving, they usually account for only a small portion of total rewards. Despite having its mining rewards slashed in half this year, Iren still managed to increase production YTD—a feat only one other miner, [$CLSK](https://x.com/search?q=%24CLSK&src=cashtag_click), has achieved so far.

[

](https://x.com/Agrippa_Inv/status/1856779712460419153/photo/3)