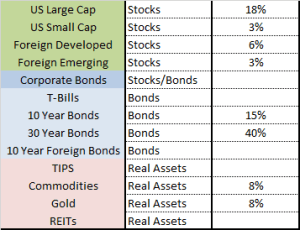

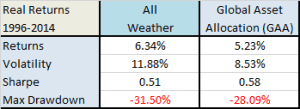

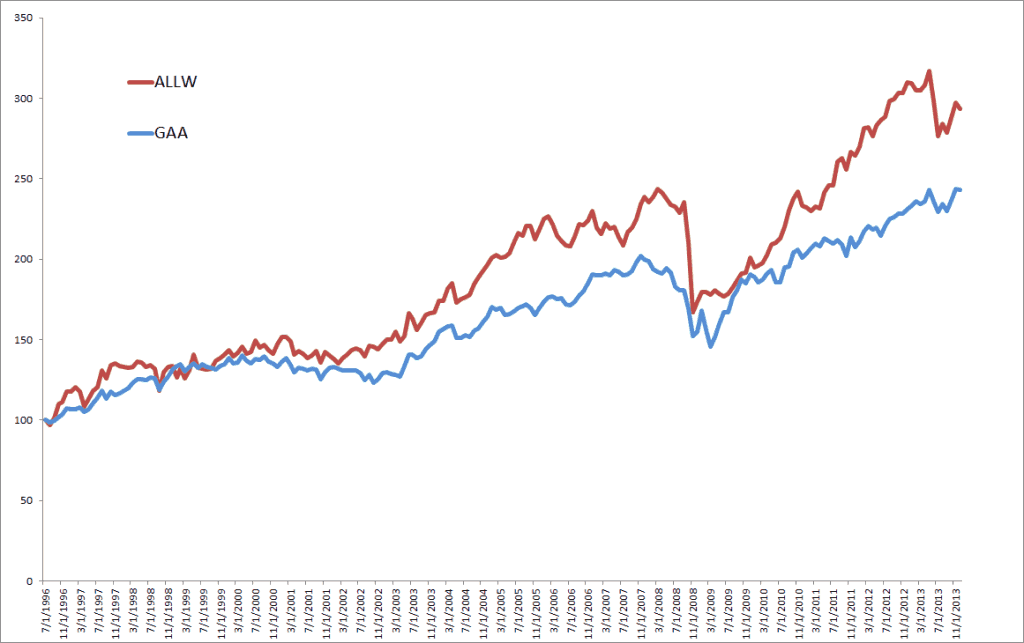

### Risk Parity Portfolio

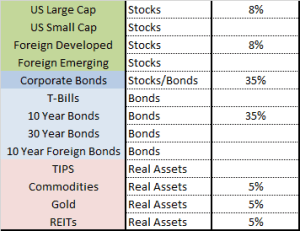

### All Seasons Portfolio

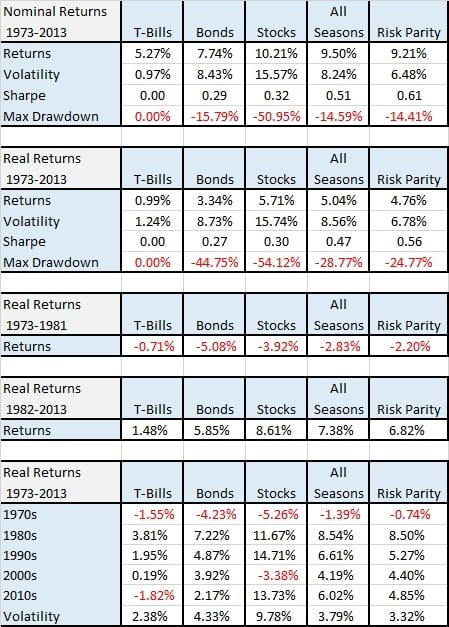

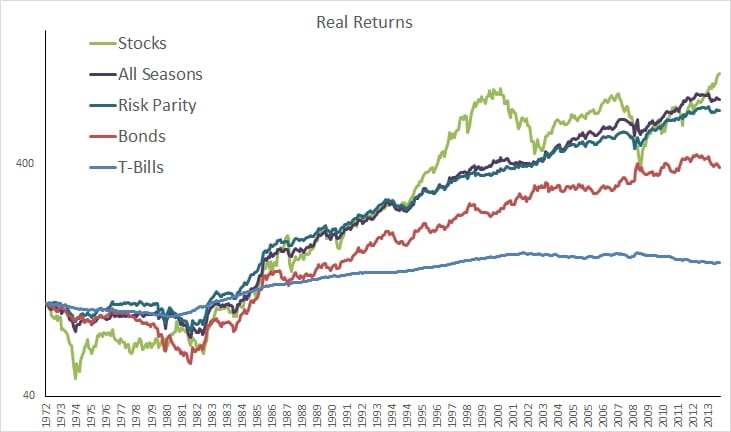

#### Return

Credit [Meb Faber Research](https://mebfaber.com/2015/05/28/chapter-4-the-risk-parity-and-all-seasons-portfolios/)

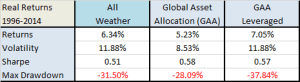

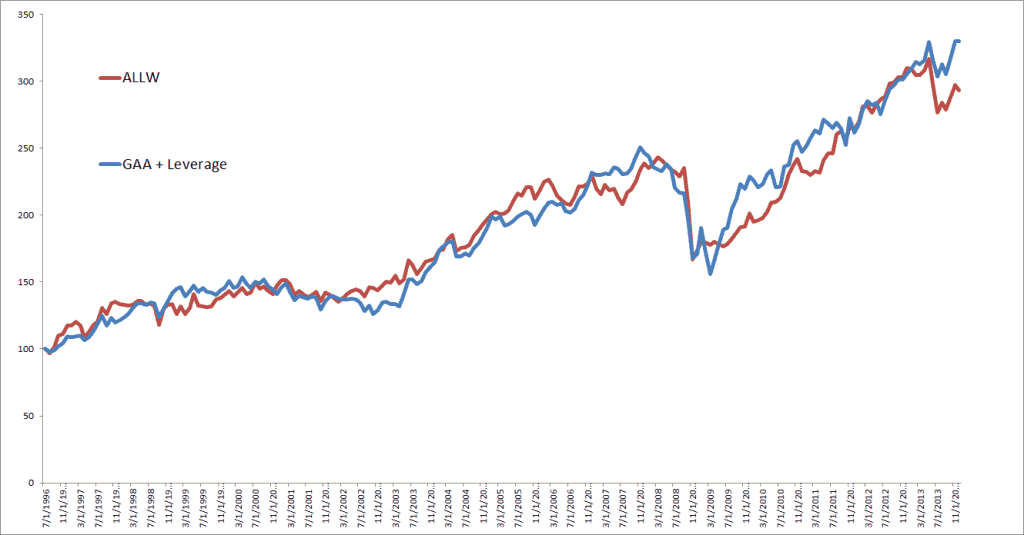

#### Global Asset Allocation (GAA)

The allocation is roughly 50% stocks, 40% bonds, and 10% real assets.

More specifically it is:

- 20% S&P500,

- 15% EAFE

- 5% EEM

- 22% Corporate Bonds

- 16% 10 Year Foreign Sov Bonds

- 15% 30 Year US

- 2% TIPS

- 5% REITs

Credit [Meb Faber Research](https://mebfaber.com/2014/12/31/cloning-the-largest-hedge-fund-in-the-world-bridgewaters-all-weather/)