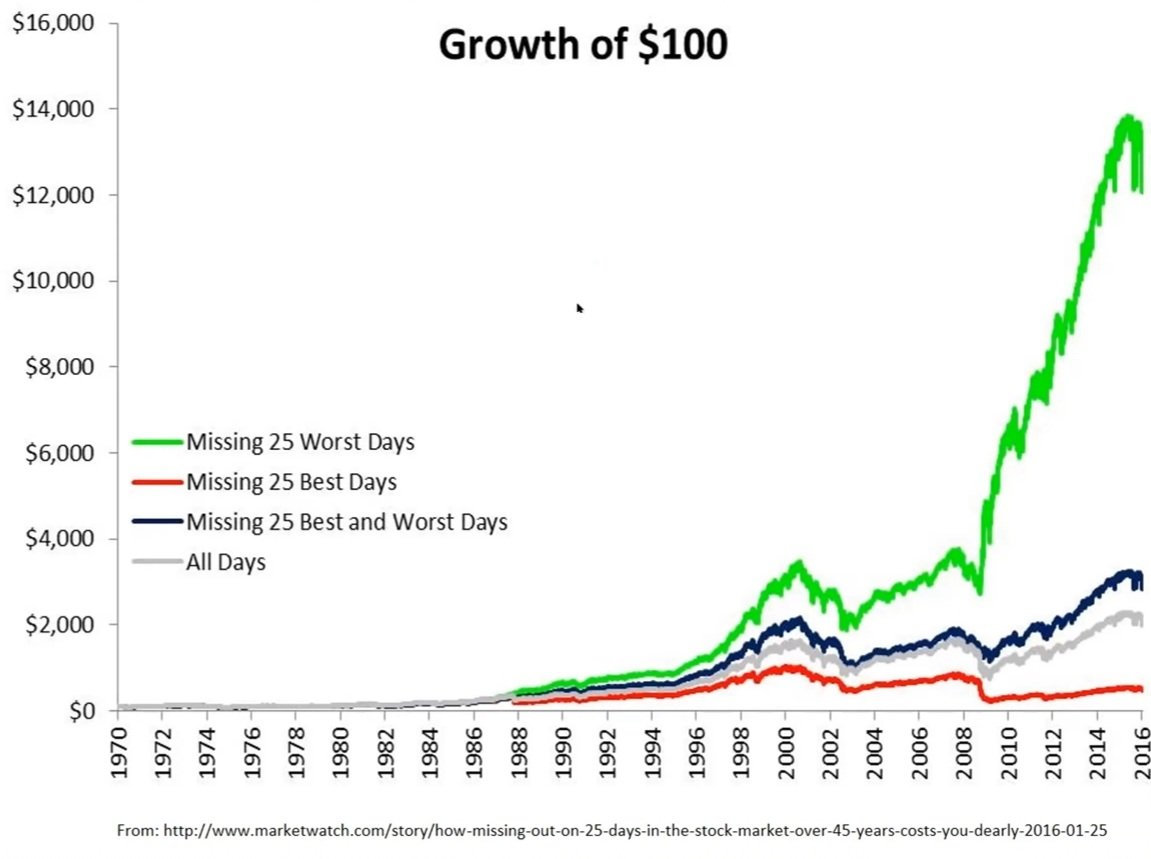

### Time in the market beats timing the market.

Avoiding volatile times during corrections yields better performance than buy and hold. See the green line.

There are different strategies on how best to trade in the stock market with different time lines. This creates a market w/ opportunity to win / lose $.

Market corrections cause huge drawdowns in the high alpha names and this negates the incredible performance during strong market uptrends

We need to best interpret **market inflection points** to come out on the right side. Hence we need to keep track of:

- Portfolio / trade performance

- Price / volume action of the market leaders

- Market Indexes

> Our goal is not to call the tops and bottoms of the economic cycles. It is to be hyper aware of them such that we can

> - As exposed / make as much progress as possible when the markets are trending higher / uptrends

> - Limit exposure / scale back to limit drawdowns when the time turns

##### Perform. Go Flat. Repeat

Market cycles between:

- Uptrends

- Consolidation

- Downtrends

We want to be able to increase exposure during the start of uptrends and start to scale back when basing periods emerge with [[potential negative expectation breakers]] which could shift the market into a downtrend.

### Watching Market Leaders - Barometer

- Stocks under significant accumulation by institutions

- Growing their earnings/sales at incredible rates and are disrupting industries

- combine the best fundamentals/ story w/ price/volume action

Watch how they break to new highs / move to the right sides of their bases / Institutions take profits and character changes of the stock.

#### Reference content

1. [Stock Market Leaders Review](https://www.youtube.com/watch?v=-OFyVwn6Vf4&ab_channel=RichardMoglen)

2. [Mark Minervini Interview](https://www.youtube.com/watch?v=-hBsPtBnZKQ&ab_channel=RichardMoglen)

3. [Finding Market Leaders & Judging Stock Market Conditions](https://www.youtube.com/watch?v=q_nTDZLdZeY&ab_channel=RichardMoglen)